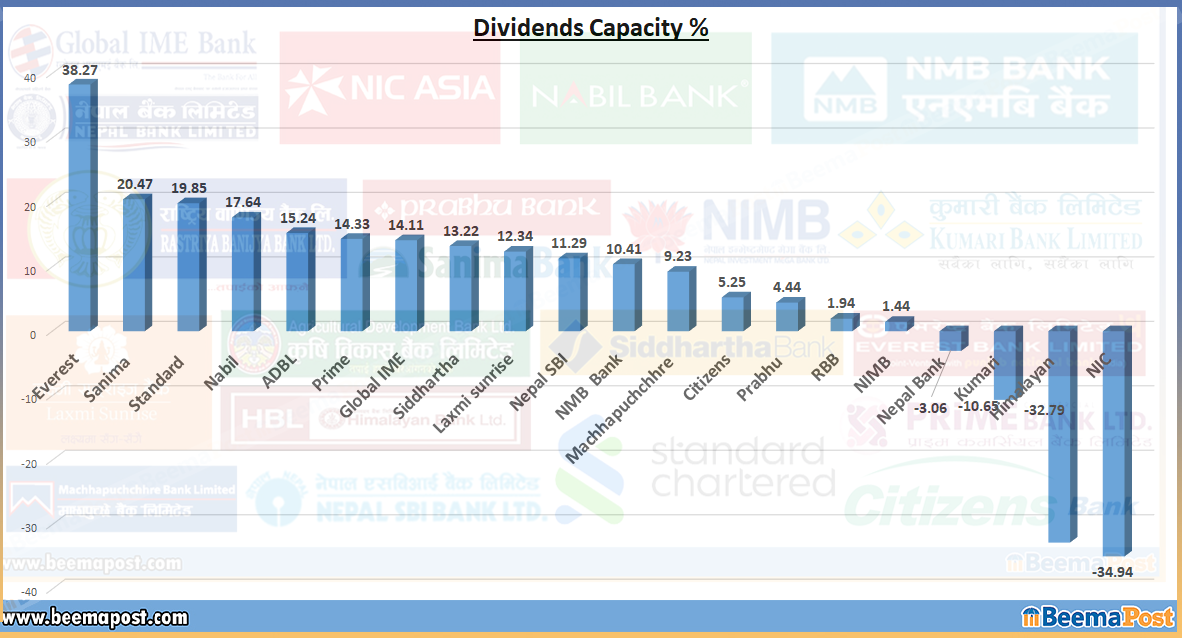

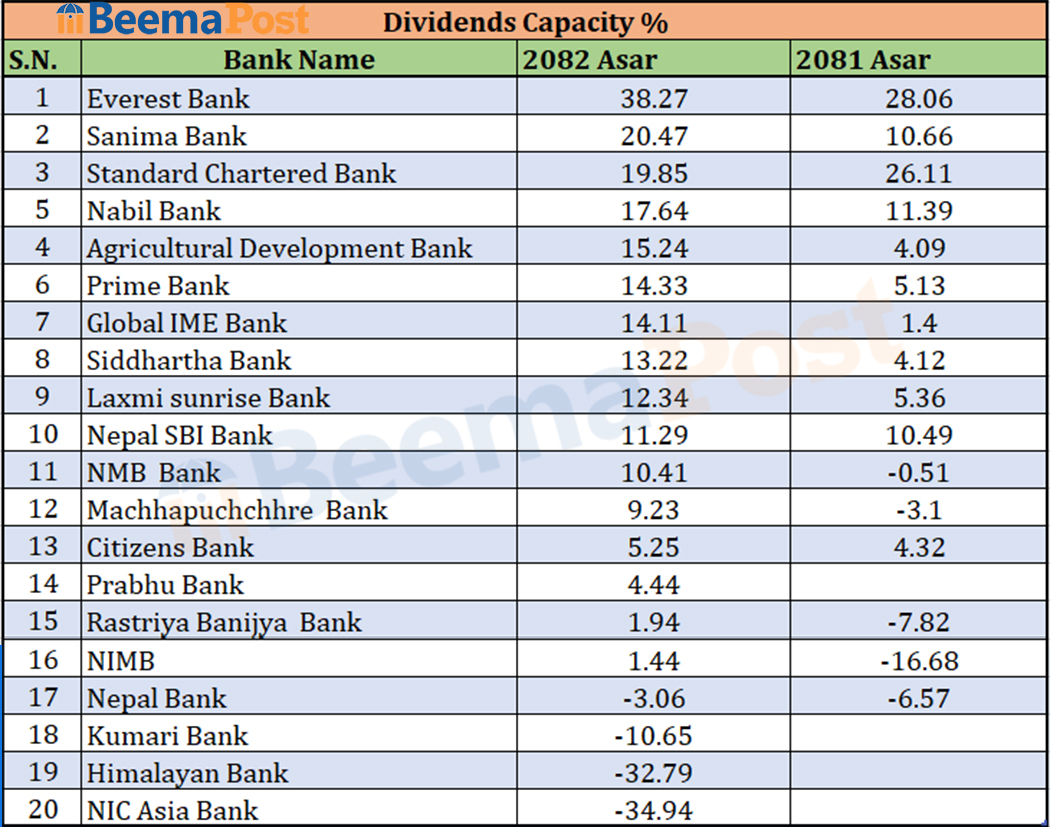

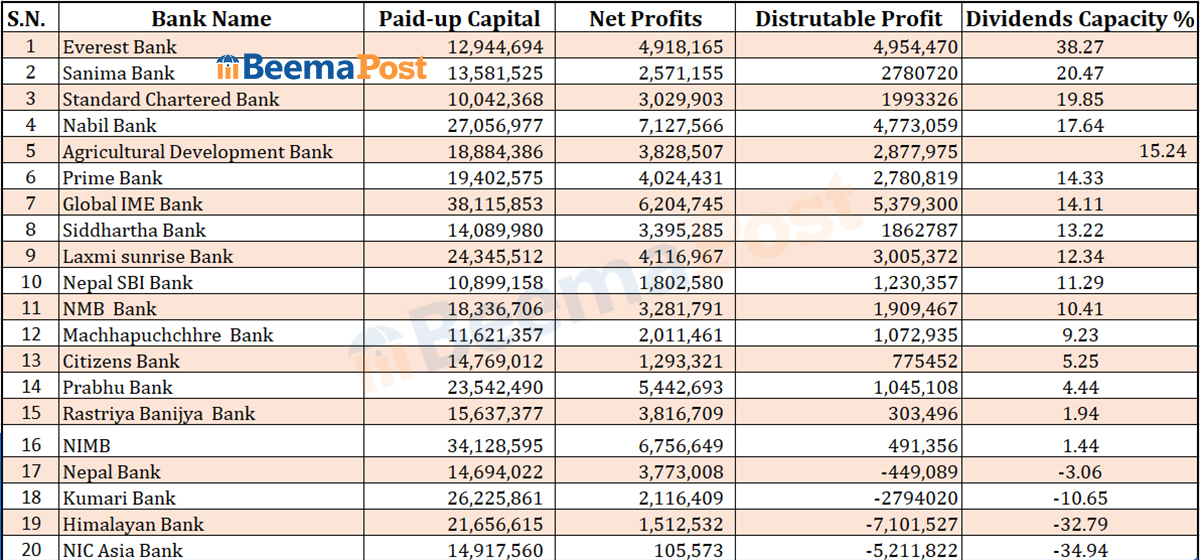

Most Commercial Banks Poised to Distribute Dividends from FY 2081/82 Profits

Kathmandu — The majority of Nepal’s commercial banks are in a position to distribute dividends to their shareholders from the profits earned in the last fiscal year (2081/82). Out of the 20 commercial banks currently in operation, only four will be unable to provide any dividends.

Everest Bank tops the list with the capacity to offer a 38.27 percent dividend, the highest among all banks. Sanima Bank follows in second place with a 20.47 percent dividend capacity. Standard Chartered Bank and Agricultural Development Bank rank next, with potential dividends of 19.85 percent and 15.24 percent, respectively.

Nabil Bank — the highest profit earner among commercial banks, which has a dividend capacity of 17.64 percent, up from 11.39 percent in the previous fiscal year.

Nabil Bank — the highest profit earner among commercial banks, which has a dividend capacity of 17.64 percent, up from 11.39 percent in the previous fiscal year.

Other banks in a position to distribute dividends include Prime Bank (14.33%), Global IME Bank (14.11%), Siddhartha Bank (14.11%), Laxmi Sunrise Bank (13.22%), Nepal SBI Bank (11.29%), and NMB Bank (10.41%).

Similarly, Machhapuchhre Bank can distribute 9.23 percent, Citizens Bank 5.25 percent, Prabhu Bank 4.44 percent, Rastriya Banijya Bank 1.94 percent, and Nepal Investment Mega Bank 1.44 percent.

Similarly, Machhapuchhre Bank can distribute 9.23 percent, Citizens Bank 5.25 percent, Prabhu Bank 4.44 percent, Rastriya Banijya Bank 1.94 percent, and Nepal Investment Mega Bank 1.44 percent.

However, Nepal Bank, Kumari Bank, Himalayan Bank, and NIC Asia Bank will not be able to pay dividends to their shareholders from last fiscal year’s profits.