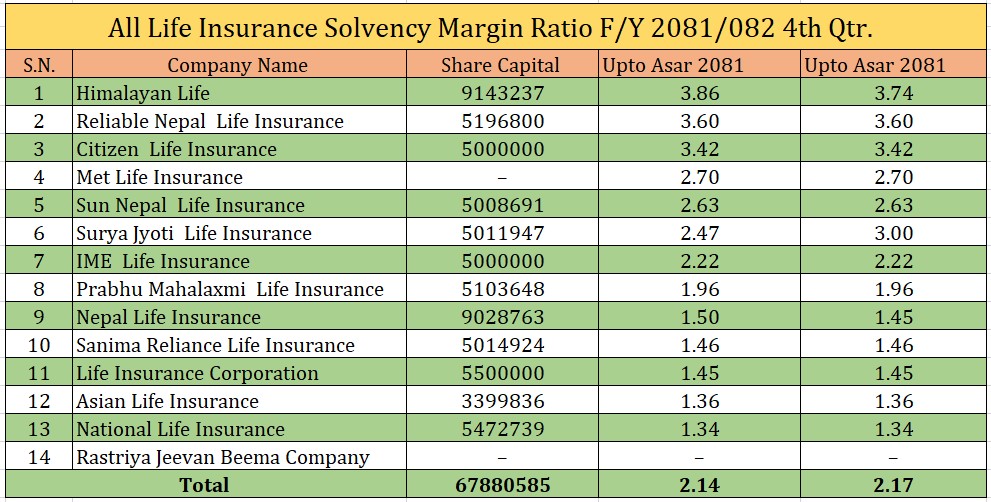

Life Insurance Companies in Nepal Maintain Strong Solvency Ratios, Himalayan Life Insurance in the Lead

Kathmandu – The average solvency ratio of life insurance companies in Nepal stood at 2.14 in the last fiscal year, reflecting a slight decline from 2.17 recorded in the previous year, according to recently published financial statements.

Among the 14 life insurance companies operating in Nepal, Himalayan Life Insurance leads the market with the highest solvency ratio of 3.86, reinforcing its reputation as one of the safest insurers in the country. Close behind is Reliable Nepal Life Insurance, which maintained its solvency ratio at 3.60, unchanged from the previous year.

Citizen Life Insurance ranked third with a solvency ratio of 3.42, also showing consistency with no change over the past two fiscal years. Meanwhile, MetLife Nepal reported a solvency ratio of 2.70, followed by Sun Nepal Life Insurance at 2.63, indicating strong risk-bearing capacity.

Other companies also posted relatively healthy ratios. SuryaJyoti Life Insurance recorded 2.47, though slightly down from 3.0 in the previous fiscal year. IME Life Insurance remained stable at 2.22, while Prabhu Mahalaxmi Life Insurance reported a ratio of 1.96.

Nepal Life Insurance showed slight improvement, with its solvency ratio increasing from 1.45 to 1.50. Similarly, Sanima Reliance Life Insurance maintained a stable ratio of 1.46.

At the lower end of the spectrum, LIC Nepal recorded a solvency ratio of 1.45, followed by Asian Life Insurance at 1.36. National Life Insurance stood at 1.34. Notably, Rastriya Jeevan Beema Company has not published its audited financial statements for a prolonged period.

Despite variations across companies, all insurers, except a few, remain well above the regulatory minimum of 1.5, as mandated by the Insurance Board.