Nepal Insurance Authority Issues New Directive to Curb Money Laundering and Terrorist Financing

Kathmandu – The Nepal Insurance Authority (NIA) has introduced a new directive aimed at preventing money laundering, terrorist financing, and financial investments linked to the production or expansion of weapons of mass destruction.

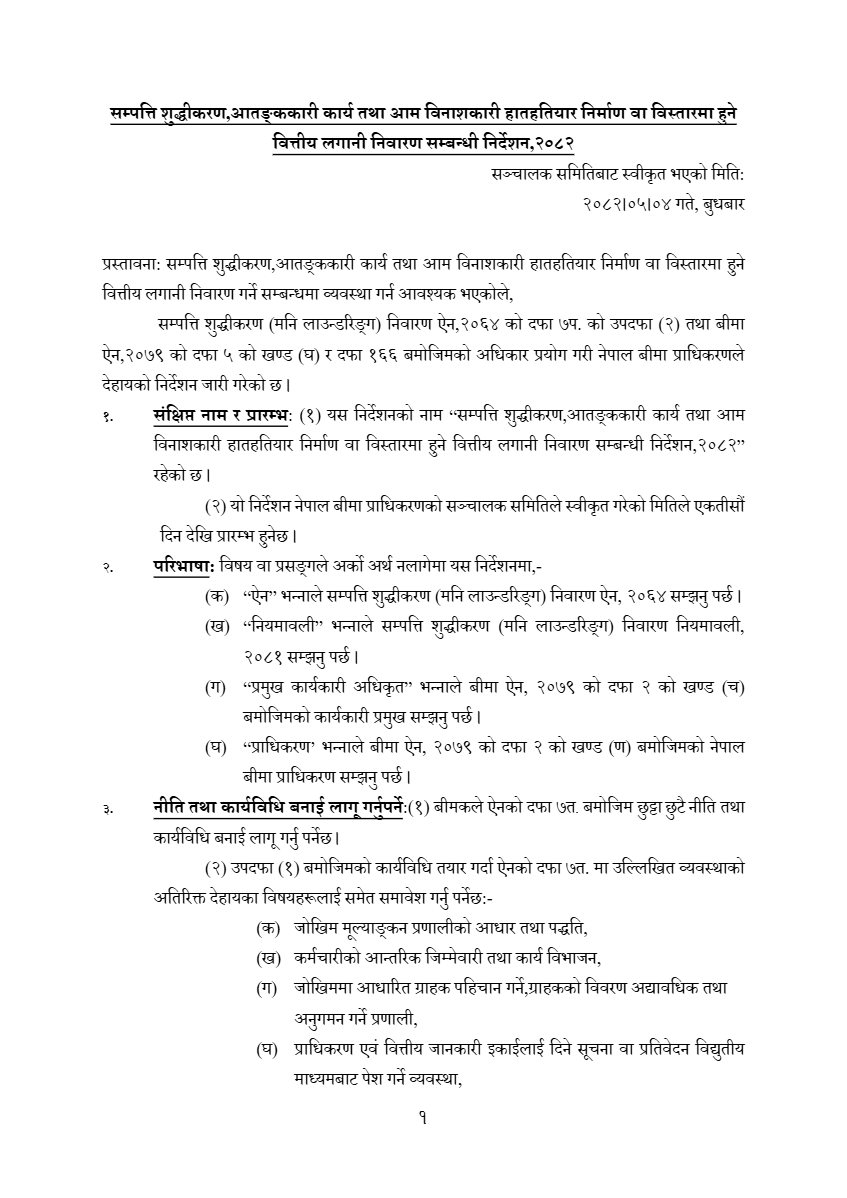

The directive, titled “Directives on Prevention of Money Laundering, Terrorist Activities and Financial Investment in the Production or Expansion of Weapons of Mass Destruction, 2082”, was approved by the NIA Board of Directors on Bhadra 4, 2082 (August 20, 2025).

Under the new rules, insurance companies must strictly comply with measures ranging from customer identification to reporting suspicious transactions. The directive makes it clear that responsibility extends across all levels—from the Chief Executive Officer (CEO) and employees to insurance intermediaries and third-party facilitators.

Insurers are required to verify customer identity using electronic records of national identity cards or citizenship certificates. They must also assess whether clients are politically exposed persons (PEPs), evaluate associated risks of their family members and affiliates, and take appropriate preventive measures.

Additionally, companies must submit suspicious transaction or activity reports directly to the Financial Intelligence Unit (FIU). The directive places special emphasis on monitoring large-scale insurance transactions, claim payments, and premium payments.

To reduce the risk of misuse, all premiums and claim settlements must be routed through the formal banking system, with cash transactions permitted only in urgent cases. Insurance companies have also been instructed to exercise caution in issuing and paying policies.

The directive mandates every insurance company to establish an Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) department, appoint a compliance officer, and submit an annual risk assessment report to the NIA. Firms must also update customer details regularly, identify ultimate beneficiaries, and securely maintain records. Details of high-ranking customers are required to be updated within six months of the directive’s issuance.