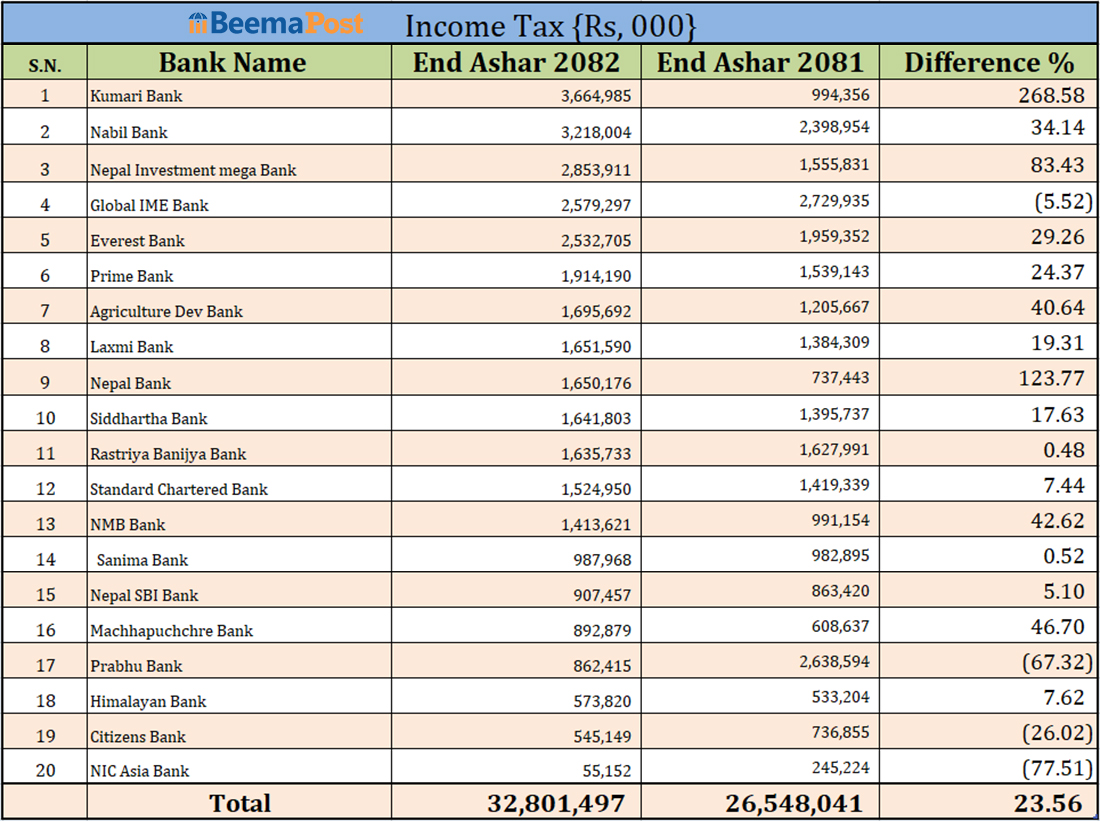

Commercial Banks in Nepal Contribute Nearly Rs 33 Billion in Income Tax to the Government

Kathmandu – Commercial banks in Nepal paid nearly Rs 33 billion in income tax to the government during the last fiscal year 2081/82, marking a significant increase compared to the previous year. According to official data, the 20 commercial banks currently in operation collectively contributed Rs 32.80 billion in revenue, up by 23.56 percent from the Rs 26.54 billion paid in the fiscal year 2080/81.

The rise in tax payments is largely attributed to the growth in profits reported by banks. Of the 20 institutions, 16 recorded an increase in income tax contributions, while four saw declines. Kumari Bank emerged as the highest taxpayer during the review period, remitting Rs 3.66 billion to the government—an impressive 268.58 percent increase from the previous fiscal year.

Nabil Bank ranked second, paying Rs 3.21 billion in income tax, 34.14 percent more than the previous year. Nepal Investment Mega Bank secured third place, contributing between Rs 2.85 billion and Rs 3.9 billion, reflecting an 83.43 percent rise. Global IME Bank, however, saw its contribution decline by 5.5 percent to Rs 2.57 billion.

Other taxpayer banks included Everest Bank, which increased its payment by 29.26 percent to Rs 2.53 billion, Prime Bank with a 24.37 percent rise to Rs 1.91 billion, Agricultural Development Bank with a 40.64 percent rise to Rs 1.69 billion, and Laxmi Sunrise Bank with a 19.31 percent increase to Rs 1.65 billion.

Similarly, Nepal Bank with Rs 1.65 billion, Siddhartha Bank with Rs 1.64 billion, Rastriya Banijya Bank paid Rs 1.63 billion, Standard Chartered with Rs 1.52 billion, NMB Bank with Rs 1.41 billion, Sanima Bank with Rs 987.5 million, Nepal SBI Bank with Rs 907.5 million, and Machhapuchhre Bank contributed Rs 892.8 million.

Meanwhile, Prabhu Bank, Himalayan Bank, Citizens Bank, and NIC Asia Bank paid between Rs 862.4 million to 55.1 million during the fiscal year.

As per legal provisions, banks and financial institutions are required to allocate 10 percent of their post-tax profits to employee bonuses, while the remaining amount is remitted to the government at a 30 percent tax rate.