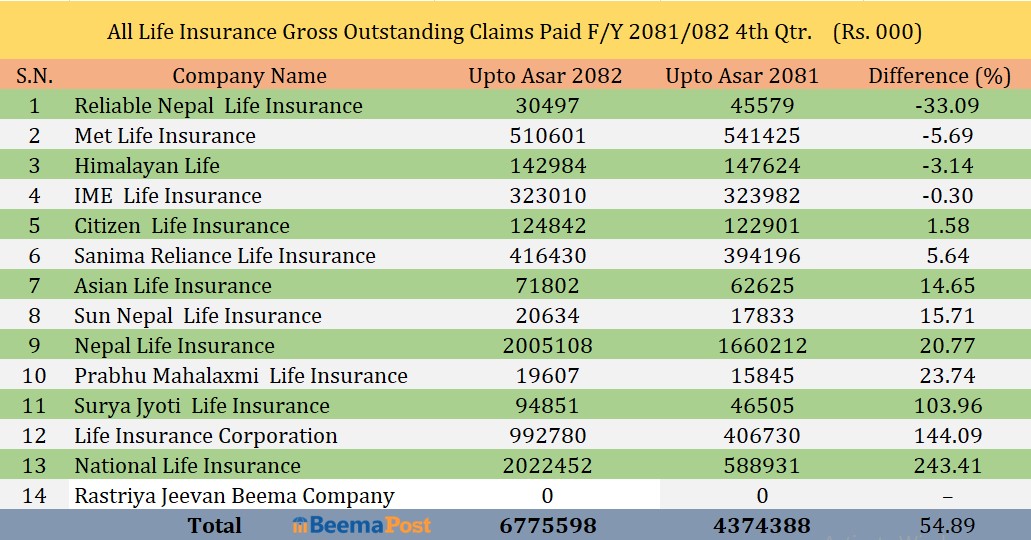

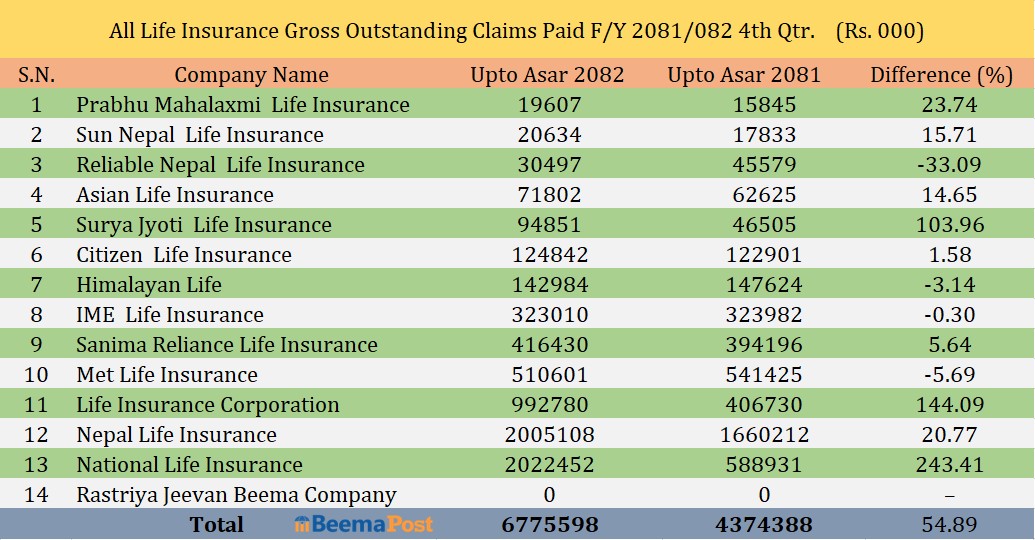

Life Insurance Companies Outstanding Claims Surge by 54.89 Percent on Q4 of FY 2081/82

Kathmandu – The outstanding claims of life insurance companies in Nepal have surged sharply, raising fresh concerns about the timely settlement of policyholder benefits. According to the fourth quarter financial statements of the last fiscal year published by 14 operating life insurers, total outstanding claims have reached Rs 6.77 billion, a steep rise of 54.89 percent compared to Rs 4.37 billion in the same period of the previous year.

Despite repeated directives from the Nepal Insurance Authority to ensure timely, simple, and hassle-free claim payments, the burden of outstanding claims on the capital of life insurers continues to grow. The situation has been described as “unsatisfactory” by industry observers, as delayed settlements directly affect policyholders and undermine trust in the insurance sector.

Notably, the outstanding claims of some companies have increased at an alarming rate. National Life Insurance recorded the highest growth, with outstanding claims surging by 243.41 percent to Rs 2.02 billion compared to the previous year. Nepal Life Insurance stood second, with outstanding claims up by 20.77 percent, totaling Rs 2.005 billion. LIC Nepal ranked third, posting a 144.09 percent rise in outstanding claims to Rs 992.7 million.

Several other companies also reported significant pending amounts. Met Life Insurance posted Rs 510.6 million in outstanding claims, Sanima Reliance Life Insurance Rs 416.4 million, IME Life Insurance Rs 323 million, and Himalayan Life Insurance Rs 142.9 million. Citizen Life Insurance reported Rs 124.8 million, followed by Suryajyoti Life Insurance at Rs 94.8 million, Asian Life Insurance at Rs 71.8 million, Reliable Nepal Life Insurance at Rs 34 million, Sun Nepal Life at Rs 20.6 million, and Prabhu Mahalaxmi Life Insurance at Rs 19.6 million.

Several other companies also reported significant pending amounts. Met Life Insurance posted Rs 510.6 million in outstanding claims, Sanima Reliance Life Insurance Rs 416.4 million, IME Life Insurance Rs 323 million, and Himalayan Life Insurance Rs 142.9 million. Citizen Life Insurance reported Rs 124.8 million, followed by Suryajyoti Life Insurance at Rs 94.8 million, Asian Life Insurance at Rs 71.8 million, Reliable Nepal Life Insurance at Rs 34 million, Sun Nepal Life at Rs 20.6 million, and Prabhu Mahalaxmi Life Insurance at Rs 19.6 million.

While most companies showed rising figures, a few insurers, including Met Life Nepal, IME Life, Himalayan Life, and Reliable Nepal Life, managed to gradually reduce their outstanding claims. This indicates relative improvement in their claim settlement processes compared to the industry trend.

Meanwhile, the situation of government-owned Rastriya Jeevan Beema Company remains unclear, as its financial statements have not been audited for a long time. Without an audit, the actual size of its outstanding claims could not be determined and was therefore excluded from the published figures.