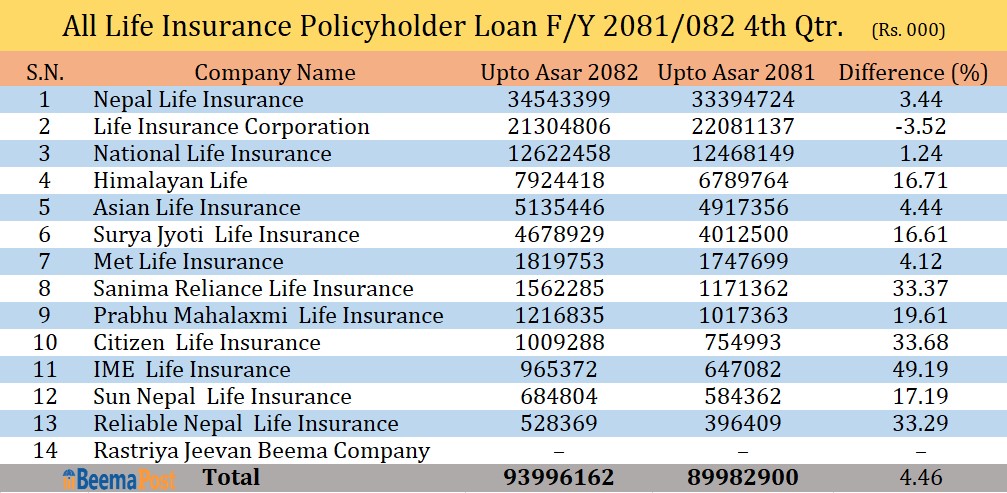

Life Insurance Companies in Nepal Disburse Rs 93.99 Billion Rupees in Policy Loans

Kathmandu – Life insurance companies operating in Nepal have extended loans worth nearly one hundred billion rupees to their insureds. During the fourth quarter of the last fiscal year, the country’s 14 life insurance companies collectively disbursed insurance policy loans totaling Rs 93.996 billion, marking a 4.46 percent increase compared to the same period in the previous fiscal year when Rs 89.983 billion was lent.

Insurance policy loans allow policyholders to borrow up to 90 percent of their policy’s surrender value after three years of premium payments. This facility provides insureds with both risk protection and access to liquidity without the need to pledge additional movable or immovable property. Insureds can repay these loans anytime during the insurance period, and in cases of default or death, the insurance company recovers the outstanding loan from the policy proceeds before settling the remaining amount with the insured or their beneficiaries. Interest on these loans is charged quarterly and is set by the respective insurance companies.

Among the companies, Nepal Life Insurance and LIC Nepal recorded the highest disbursements. Nepal Life Insurance, the largest insurer in the country, provided Rs 34.54 billion in policy loans, while LIC Nepal disbursed Rs 21.30 billion. Other major lenders included National Life Insurance with Rs 12.62 billion, Himalayan Life Insurance Rs 7.92 billion, and Asian Life Insurance Rs 5.13 billion.

During the period, IME Life Insurance and Citizen Life Insurance also increased their lending significantly with Rs 965.3 million and Rs 1 billion respectively. Additionally, Suryajyoti Life (Rs 4.67 billion), Met Life (Rs 1.81 billion), Sanima Reliance Life (Rs 1.56 billion), Prabhu Mahalaxmi Life (Rs 1.21billion), Sun Nepal Life (Rs 684.8 million), and Reliable Nepal Life (Rs 528.3 million), also collectively contributed to the growing trend of policy-backed loans.

During the period, IME Life Insurance and Citizen Life Insurance also increased their lending significantly with Rs 965.3 million and Rs 1 billion respectively. Additionally, Suryajyoti Life (Rs 4.67 billion), Met Life (Rs 1.81 billion), Sanima Reliance Life (Rs 1.56 billion), Prabhu Mahalaxmi Life (Rs 1.21billion), Sun Nepal Life (Rs 684.8 million), and Reliable Nepal Life (Rs 528.3 million), also collectively contributed to the growing trend of policy-backed loans.

The government-owned Rastriya Jeevan Beema Company has yet to provide detailed figures, as its financial statements remain unaudited, leaving the exact volume of policy loans undisclosed.