Insurance Sector Provides Rs 11.41 Billion in Employee Facilities Annually

Kathmandu – Nepal’s insurance sector has increasingly become an attractive employment destination, with more than 12,000 employees receiving service facilities annually. According to the financial statements of the last fiscal year, a total of 12,251 employees working in life and non-life insurance companies were provided with employee benefit expenses amounting to Rs 11.95 billion. This represents a 4.75 percent rise compared to the previous fiscal year, when the amount stood at Rs 11.41 billion.

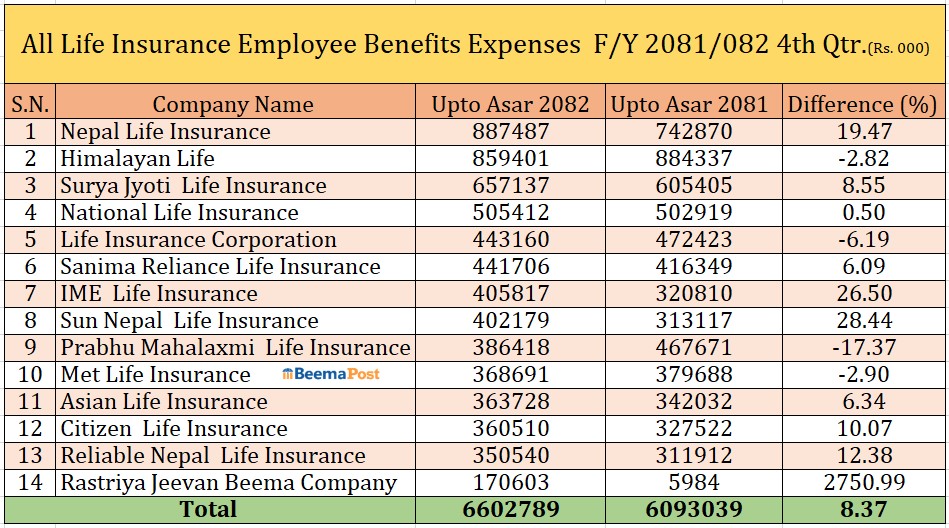

The 14 life insurance companies collectively spent Rs 6.6 billion on 6,113 employees, registering an annual growth of 8.37 percent in service facilities, which include salaries, bonuses, training, and both domestic and foreign tours. Among them, Nepal Life Insurance topped the chart with Rs 887.4 million in employee benefits, marking a 19.47 percent increase from the previous year. Himalayan Life followed with Rs 859.4 million.

The remaining companies also made significant contributions to staff welfare with SuryaJyoti Life (Rs 657.1 million), National Life (Rs 505.4 million), LIC Nepal Life (Rs 443.1 million), Sanima Reliance Life (Rs 441.7 million), IME Life (Rs 405.8 million), Sun Nepal Life (Rs 402.1 million), Prabhu Mahalaxmi Life (Rs 386.4 million), Metlife Insurance (Rs 368.6 million), Asian Life (Rs 363.7 million), Citizen Life (Rs 360.5 million), Reliable Life (Rs 350.5 million) and Rastriya Jeevan Beema Company (Rs 170.6 million).

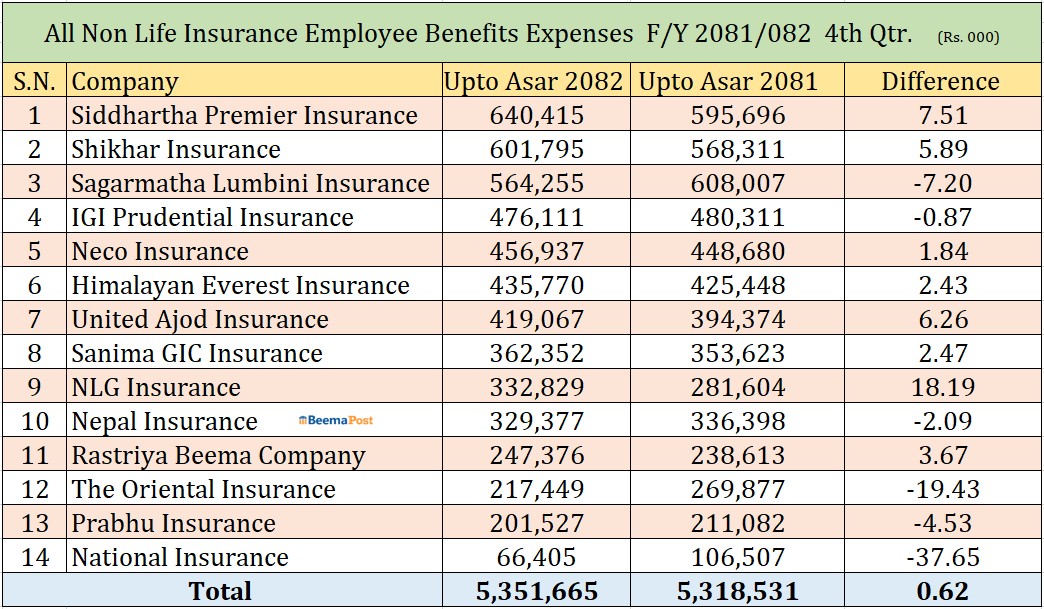

Non-life insurance companies, on the other hand, spent Rs 5.35 billion on 6,138 employees during the same period. Companies in this category also distributed special bonuses to staff during Dashain, the fiscal year-end, and on other occasions. Siddhartha Premier Insurance led the group with Rs 640.4 million in employee facilities, closely followed by Shikhar Insurance with Rs 601.7 million, Sagarmatha Lumbini Insurance with Rs 564.2 million, and IGI Prudential Insurance with Rs 476.1 million.

Other major contributors included Neco Insurance (Rs 456.9 million), Himalayan Everest Insurance (Rs 435.7 million), United Ajod Insurance (Rs 419 million), Sanima GIC Insurance (Rs 362.3 million), NLG Insurance (Rs 332.8 million), Nepal Insurance (Rs 329.3 million), Rastriya Beema Company ( Rs 247.3 million), The Oriental Insurance ( Rs 217.4 million), Prabhu Insurance (Rs 201.5 million) and National Insurance (Rs 66.4 million)

Beyond financial benefits, insurance companies have increasingly focused on employee development through specialized training programs, including capacity building and anti-money laundering awareness. While the sector continues to expand its branch network and workforce, the pace of new job creation has slowed due to the ongoing economic challenges and mergers among companies. Nevertheless, the sector remains one of the largest employment generators in Nepal’s financial industry, with gradual improvement being observed in recent years.