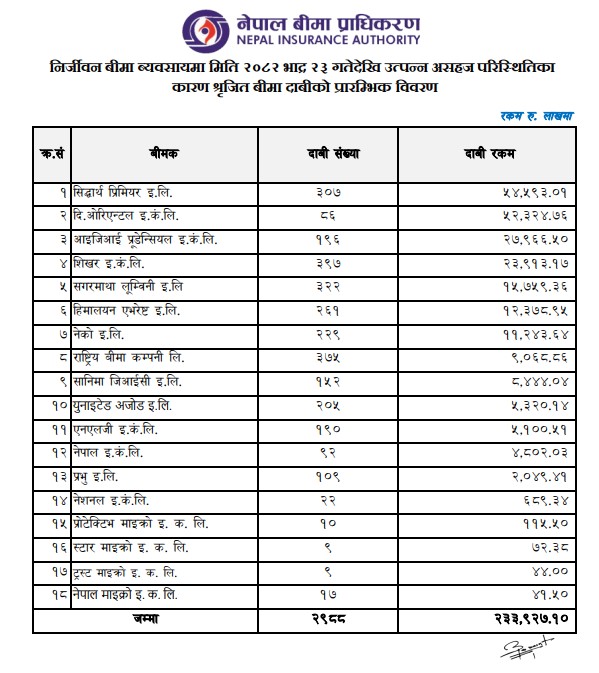

Insurance Claims from Gen Z Protest Exceed Rs 23.39 Billion

Kathmandu — The Nepal Insurance Authority has reported that insurance claims linked to the recent Gen Z protest, which began on Bhadra 23, have crossed Rs 23.39 billion. By Ashoj 8, a total of 2,988 claims had been filed across the country, highlighting the scale of damage reported by affected policyholders.

Among insurance companies, Siddhartha Premier Insurance has received the largest claim volume in terms of value, amounting to Rs 5.45 billion from 307 claims nationwide. The Oriental Insurance ranks second, with Rs 5.23 billion filed through 86 claims, while IGI Prudential Insurance stands third, reporting Rs 2.79 billion from 196 claims. Shikhar Insurance has so far received Rs 2.39 billion from 397 claims, while Sagarmatha Lumbini Insurance has reported Rs 1.57 billion from 322 claims. Himalayan Everest Insurance and Neco Insurance have also registered substantial claims of Rs 1.23 billion and Rs 1.12 billion, respectively.

The government-owned Rastriya Beema Company has reported insurance claims worth Rs 906.8 million from 375 cases. Similarly, Sanima GIC Insurance has filed Rs 844.4 million from 152 claims, United Ajod Insurance Rs 532 million from 205 claims, NLG Insurance Rs 510 million from 190 claims, and Nepal Insurance Company Rs 482 million from 92 claims. Prabhu Insurance has reported Rs 204.9 million from 109 claims, while the private National Insurance Company has received Rs 68.9 million from 22 claims.

The government-owned Rastriya Beema Company has reported insurance claims worth Rs 906.8 million from 375 cases. Similarly, Sanima GIC Insurance has filed Rs 844.4 million from 152 claims, United Ajod Insurance Rs 532 million from 205 claims, NLG Insurance Rs 510 million from 190 claims, and Nepal Insurance Company Rs 482 million from 92 claims. Prabhu Insurance has reported Rs 204.9 million from 109 claims, while the private National Insurance Company has received Rs 68.9 million from 22 claims.

Micro-insurers too have been affected, with Protective Micro Insurance recording 10 claims worth Rs 15 million, Star Micro Insurance nine claims worth Rs 7.2 million, Trust Micro Insurance nine claims worth Rs 4.4 million, and Nepal Micro Insurance 17 claims worth Rs 4.1 million.