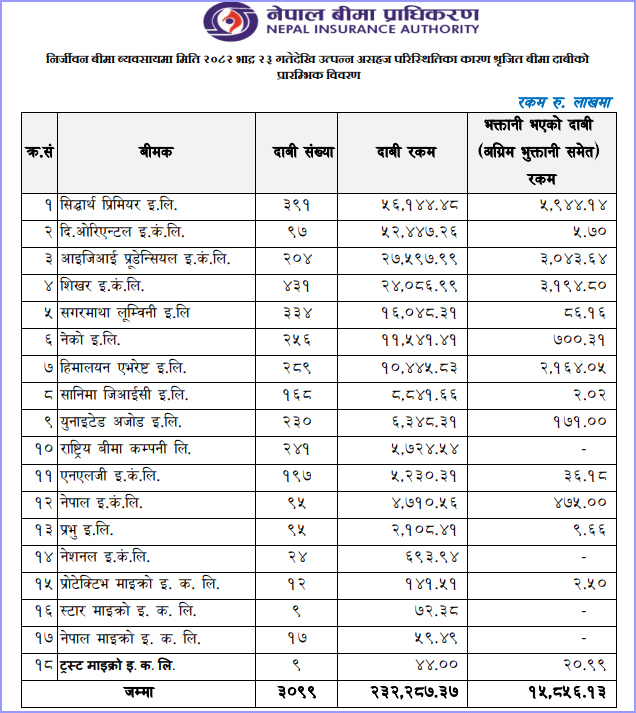

Insurance Claims from Gen-Z Protest Reach Over Rs 23 Billion

Kathmandu — The Nepal Insurance Authority has reported that the total initial insurance claims filed following the Gen-Z protest, which began on Bhadra 23, have reached a staggering Rs 23.22 billion. As of Ashoj 23, a total of 3,099 insurance claims have been registered across various non-life insurance companies.

According to the data published by the Nepal Insurance Authority, non-life insurance companies have collectively paid Rs 1.58 billion to claimants so far, including both final settlements and advance payments.

Among the insurers, Siddhartha Premier Insurance has received the highest number of claims and payout amounts. The company has registered initial claims worth Rs 5.61 billion from 391 cases nationwide. Out of this, Rs 594.4 million has already been distributed to policyholders.

The Oriental Insurance stands second in terms of total claim amount, having received Rs 5.24 billion from 97 claims across the country. However, the company has made comparatively lower payments, settling only Rs 570,000 as of Ashoj 23.

Source: Nepal Insurance Authority

Similarly, IGI Prudential Insurance ranks third, with total claims amounting to Rs 2.75 billion from 204 cases. The company has paid Rs 304.3 million in claim settlements to date.

Shikhar Insurance has reported initial claims of Rs 2.40 billion from 431 cases, with Rs 319.4 million already disbursed. Meanwhile, Sagarmatha Lumbini Insurance has received claims worth Rs 1.60 billion from 334 cases, of which Rs 8.6 million has been settled.

Neco Insurance has registered 256 claims totaling Rs 1.15 billion and has paid Rs 70 million, while Himalayan Everest Insurance has received 289 claims amounting to Rs 1.44 billion, settling Rs 216.4 million so far.

Other insurers have also begun releasing payments. Sanima GIC Insurance has disbursed Rs 200,000; United Ajod Insurance has paid Rs 17.1 million; NLG Insurance Rs 3.6 million; Nepal Insurance Rs 47.5 million; and Prabhu Insurance Rs 966,000.