Who is an Insurance Agent? What are the do’s and Don’ts of an Insurance Agent?

Purushottam Nepal

Kathmandu : In simple language, a person who works as an intermediary between the insured and the insurer is called an insurance agent. Agents are considered as backbone in life insurance companies.

The insurance agent is the person who coordinates the insured on behalf of the insurer based on a fixed commission of the company.

Access to insurance has not yet reached the general public. For insurance, the main profession of the agent is to reach out to the insured and give public awareness. That is why this profession is also called a service profession. Insurance agents encourage people to take insurance by informing the insured about the policy of the insurance company and all the provisions about the type of insurance, facilities and benefits etc.

What are the qualifications required to become an insurance agent?

For insurance agents, there is a provision that the minimum educational qualification should be SLC or similar examination, while in the current situation, agent training is also mandatory. Any person who has attained the educational qualification can become an agent, but for that, the person must also pass the exam along with the insurance agent training conducted by the insurance committee or the relevant insurer. After that, they can apply for an insurance agent’s license in the format prescribed by the insurance committee and get the license and become an agent.

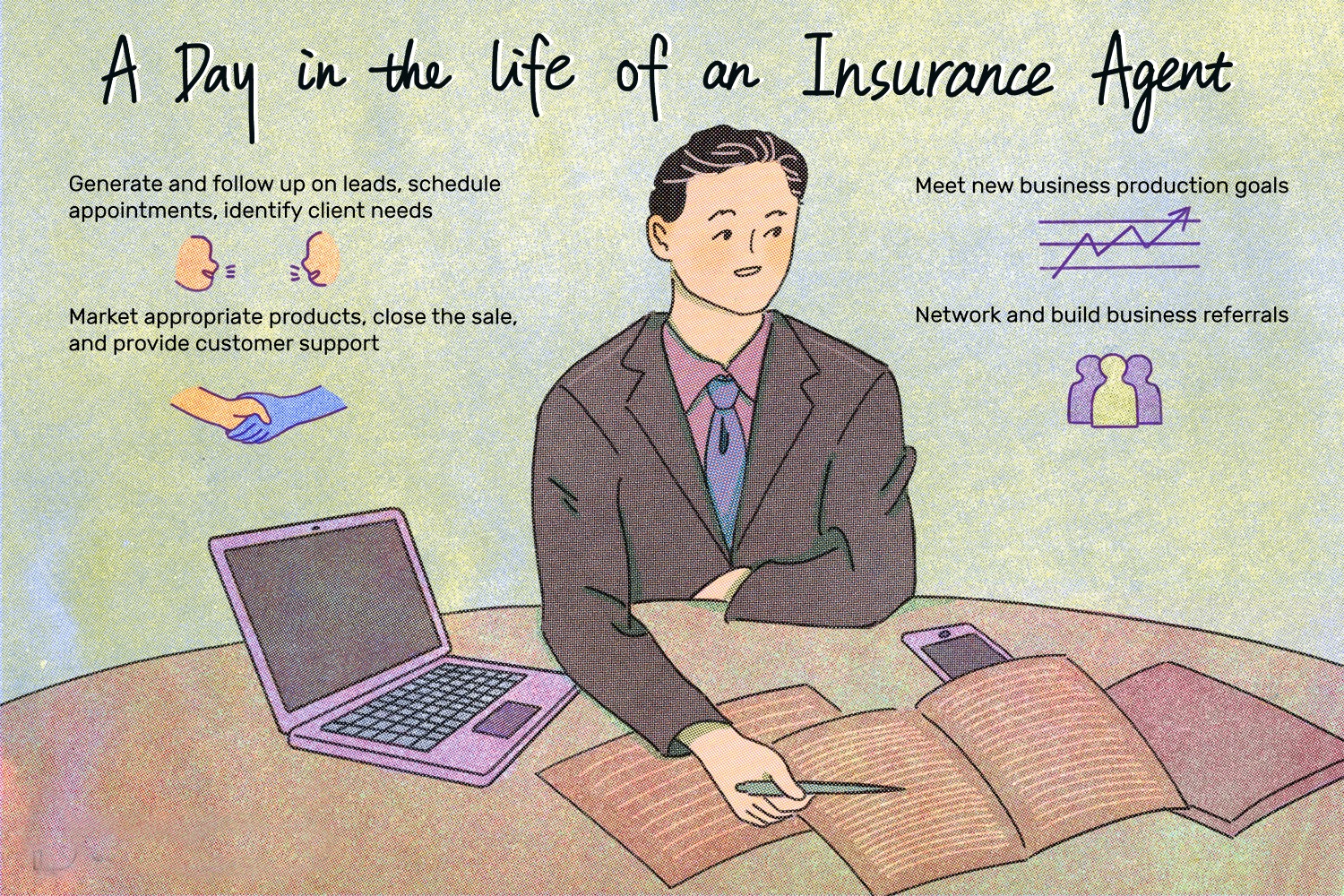

What are the duties and responsibilities of an insurance agent?

After obtaining the insurance agent’s license, the agent must perform his work and duties within the jurisdiction specified by the regulatory body Insurance Authority. The main job of an agent is to contact people who want to get insurance as a representative on behalf of the insurance company, Assisting in filling the insurance proposal form, providing necessary advice to the insured regarding insurance and providing necessary support to the insured’s family during claim payment etc.

What are the things that the insurance agent should follow?

The insurance agent must always carry the license of the insurance agent, including the type of insurance obtained from the insurance committee, and the customer must show such license if he wishes. The agent shall inform the client of the actual details of the insurance for which he is the agent (capital structure, investment policy, financial status etc.) Should be informed. All the details to be disclosed in the proposal form should be disclosed to the customer and the related documents should be taken from the customer and submitted to the insurer. The agent must also inform the customer about all the conditions and facilities mentioned in the insurance policy.The insurance agent must provide separate information to the insurer about the customer’s occupation, social status and level, and if necessary, the insurer must also provide additional details required for underwriting work.

If requested by the insured, the agent must pay the insurance fee at a specified time, renew the insurance policy, change and select the desired person, claim a loan against the insurance policy or provide other necessary insurance related services and help.

The agent must immediately inform the customer of the decision of the insurer on the acceptance of the insurer’s proposal. If the customer pays the insurance fee through the insurance agent, the insurance agent must immediately give the official compensation or receipt to the customer. And unless such insurance fee is out of control, it should be filed with the relevant insurer on the same day if possible and if not, by the next day. Insurance proposal form, Forms to be filled by the proposer, such as health details form etc., are to be filled by the proposers themselves. If the proposer is illiterate or unable, such forms should be filled by a person trusted by the proposer.

What are the activities that should not be done by an insurance agent?

An insurance agent should not sell insurance products without renewing his license and should not hide any necessary details related to insurance that he knows about the customer without telling the relevant insurer, and should not reveal them to persons and organizations other than the relevant insurer. Agents should not mistreat, extort, entice, or give any part of the commission they receive to the customer, or pretend to give any part of the commission they receive, and compete with other insurance agents to interfere unnecessarily in their business, and should not take any part of the amount received for the insurance policy from the insured or the insured’s rightful owner.

Agents should not mistreat, extort, entice, or give any part of the commission they receive to the customer, or pretend to give any part of the commission they receive, and compete with other insurance agents to interfere unnecessarily in their business, and should not take any part of the amount received for the insurance policy from the insured or the insured’s rightful owner. The organization or the director of that organization or his close relative should not be the founder or director of any insurer or take 10 percent or more shares of any insurer.

An insurance agent should not advertise falsely about any insurance that he is not an agent and not receive the amount for the insurance fee until the insurance proposal is approved and should not do business in violation of other prevailing laws while conducting his professional business.

What are the qualities that a successful agent should have?

The insurance agent should be aware of all the company’s insurance articles, financial security, bonus rate, financial condition, etc., due to which the insurance agent gains confidence and customer satisfaction. If the agent has charm in speech, politeness in behavior, quickness in work, simplicity and reliability, such people can increase in insurance business. An agent should stick to his profession, continue to serve the customer and be dedicated to the interests of the insurance company, while the insurance agent should identify potential customers and meet them regularly.

To be a successful insurance agent, the agent must present the insurance plan according to his plan and the customer’s wishes and must prepare and keep the record of his customer’s insurance plan, insurance fee, insurance renewal, insurance termination, advance payment etc. safely. Similarly, an insurance agent should have an excellent business style. Customers can get angry, angry, and ignore some things without being satisfied. In such a situation, a successful agent must have the ability and efficiency to convince the customer and motivate them to take insurance. The agent should get information about the entire scope of the insurance company. In which there should be information about risk bearing, assistance to the underwriter, information about new insurance articles, information about insurable life insurance, faith and service of the insured.

In order to achieve success in the competitive market, the insurance agent should be fully informed about the new insurance policies introduced by the insurance company. A successful agent should also have the ability to win the customer’s trust with strong determination and lasting trust.