United Ajod Insurance Reports Strong Premium Growth in First Quarter

Kathmandu — United Ajod Insurance Limited has published its first-quarter financial statement for the current fiscal year 2082/83, showcasing strong growth in key business indicators, including insurance premium income and customer expansion.

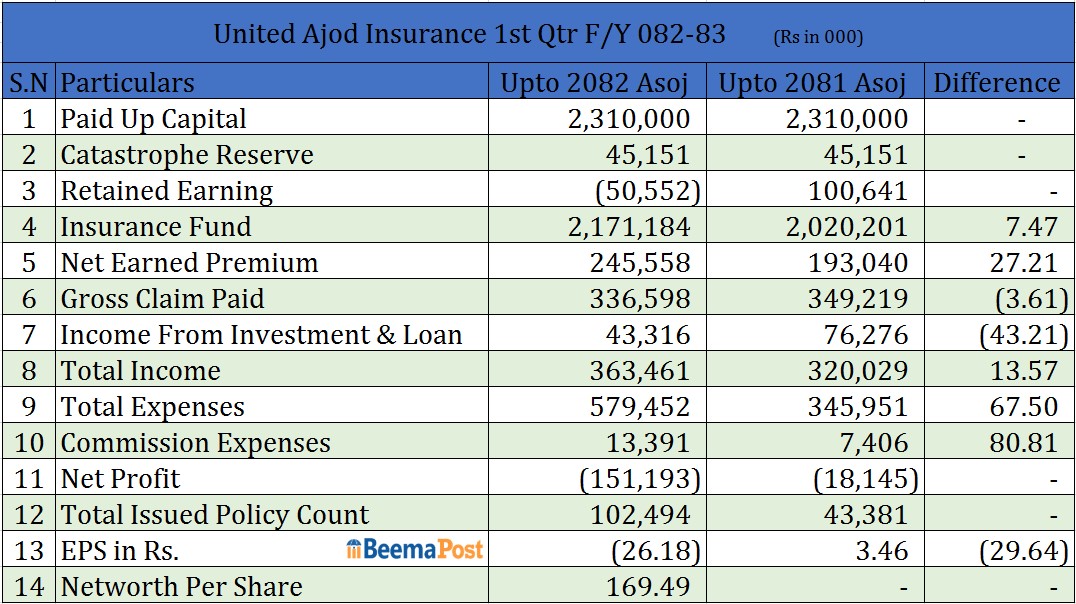

The company’s net insurance premium increased by 27.21 percent compared to the same period of the previous fiscal year. United Ajod earned Rs 193 million in net premiums during the first three months of the previous year, which has now risen to Rs 245.5 million.

Similarly, the company’s total income grew by 13.57 percent, reaching Rs 363.4 million, up from Rs 320.2 million in the previous fiscal year. However, income from investment and loans declined to Rs 433.16 million, down from Rs 762.2 million.

Despite these gains, the company’s profit has been impacted this quarter. United Ajod Insurance received claims amounting to several crores following property damage caused during the Gen-Z movement, which significantly affected profitability. As a result, the company recorded a net loss of Rs 151.1 million in the first quarter.

During the review period, United Ajod made direct claim payments totaling Rs 335.5 million, slightly lower than the Rs 349.2 million paid during the same period last fiscal year.

The company’s total expenses rose sharply by 67.50 percent, reaching Rs 579.4 million, compared to Rs 345.9 million previously. This increase is attributed mainly to business expansion, investment in new insurance products, and enhanced customer service initiatives.

Commission payments to agents also rose notably. The company paid Rs 13.4 million in commissions in the first quarter, up by 80.81 percent from Rs 7.4 million last year.

United Ajod Insurance currently maintains a paid-up capital of Rs 2.31 billion, a special reserve of Rs 1.21 billion, a disaster fund of Rs 4.5 billion, and a reserve fund of Rs 50 million.

As of the end of Ashoj, the company’s net worth per share stood at Rs 169.49, while earnings per share were negative Rs 26.18, mainly due to high claim expenses during the period.