Life Insurance Fund Reports Rs 845.1 Billion as All 14 Life Insurance Companies Publish Q1 Results

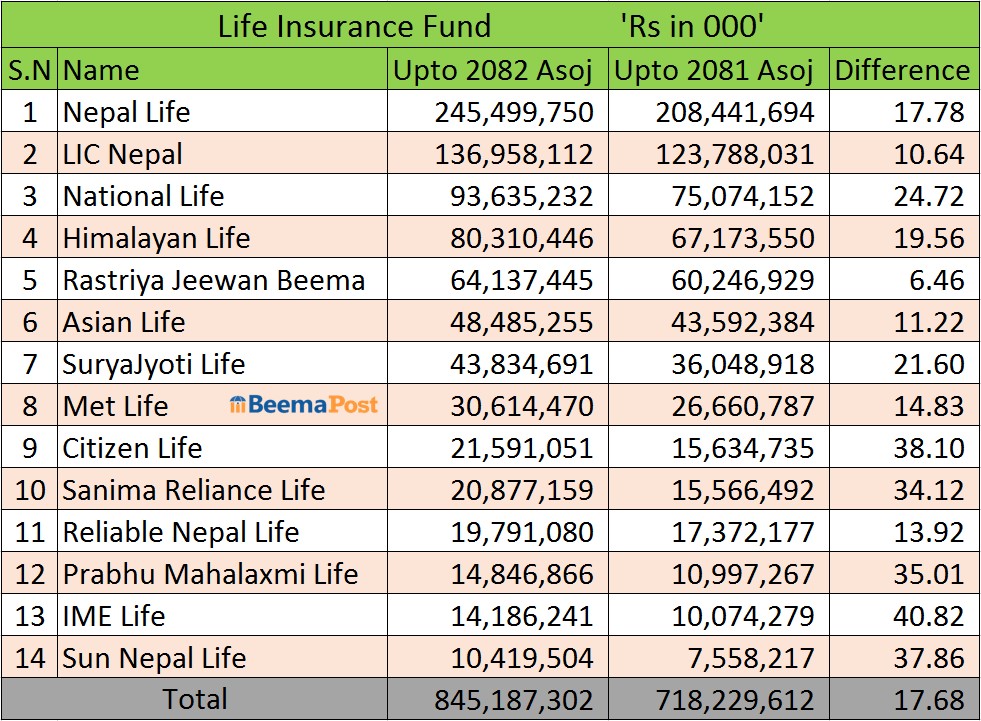

Kathmandu – All 14 life insurance companies operating in Nepal have released their first-quarter financial statements for the current fiscal year, revealing that the sector’s life insurance fund has reached Rs 845.18 billion.

By end of Ashoj of the previous fiscal year, the combined life insurance fund stood at Rs 718.22 billion. This year, the fund has expanded by 17.68 percent, reflecting the strengthening financial capacity of insurers to manage future claim obligations. The life insurance fund is maintained separately from each company’s general fund and is used exclusively to settle policyholder claims. A larger fund indicates stronger claim-paying ability and financial health.

Nepal Life Insurance continues to lead the market with the largest life insurance fund of Rs 245.49 billion, followed by LIC Nepal with Rs 136.95 billion, and National Life with Rs 93.63 billion. Himalayan Life has built a fund of Rs 80.31 billion, while the government-owned Rastriya Jeevan Beema Company holds Rs 64.13 billion. Asian Life and Suryajyoti Life have accumulated funds of Rs 48.48 billion and Rs 43.83 billion, respectively.

Met Life has an insurance fund of Rs 30.61 billion, Citizen Life stands at Rs 21.59 billion, Sanima Reliance Life at Rs 20.87 billion, and Reliable Nepal Life at Rs 19.79 billion. Prabhu Mahalaxmi Life has collected Rs 14.84 billion, IME Life has Rs 14.18 billion, and Sun Nepal Life maintains a fund of Rs 10.41 billion.

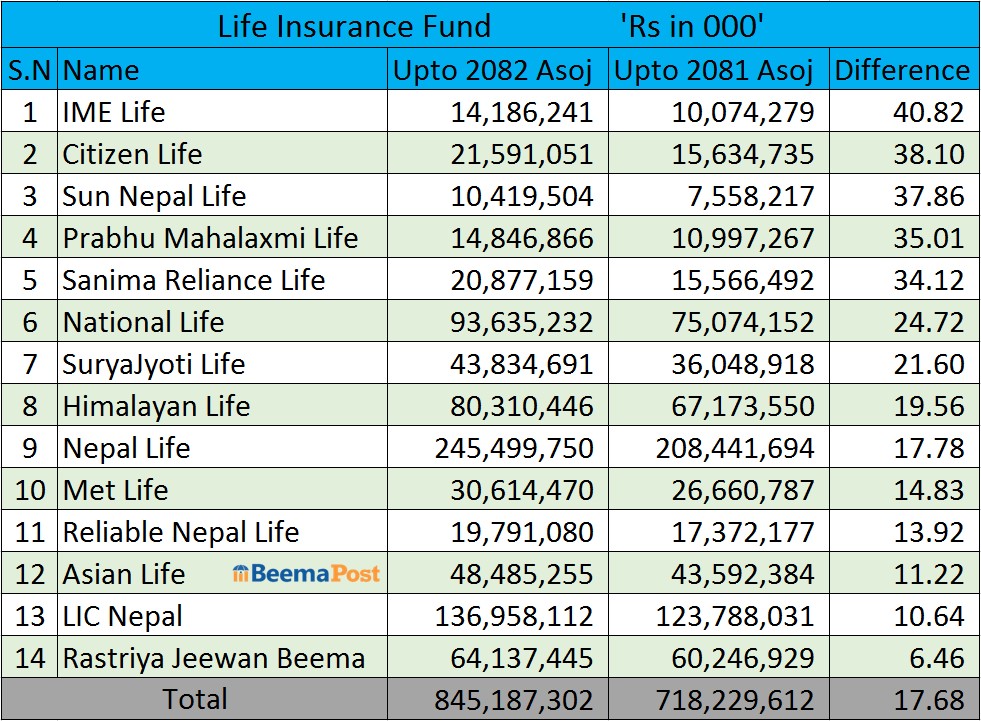

In terms of growth, IME Life recorded the sharpest increase, expanding its life insurance fund by 40.82 percent compared to the same period last year. It is followed by Citizen Life with a growth of 38.10 percent, Sun Nepal Life with 37.86 percent, and Prabhu Mahalaxmi Life with 35.01 percent. Sanima Reliance Life and National Life also posted strong growth, expanding by 34.12 percent and 24.72 percent, respectively.

In terms of growth, IME Life recorded the sharpest increase, expanding its life insurance fund by 40.82 percent compared to the same period last year. It is followed by Citizen Life with a growth of 38.10 percent, Sun Nepal Life with 37.86 percent, and Prabhu Mahalaxmi Life with 35.01 percent. Sanima Reliance Life and National Life also posted strong growth, expanding by 34.12 percent and 24.72 percent, respectively.

Suryajyoti Life’s insurance fund increased by 21.60 percent, Himalayan Life by 19.56 percent, Nepal Life by 17.78 percent, and Met Life by 14.83 percent. Reliable Nepal Life’s fund rose by 13.92 percent, Asian Life by 11.22 percent, LIC Nepal by 10.64 percent, and the Rastriya Jeevan Beema Company by 6.46 percent.