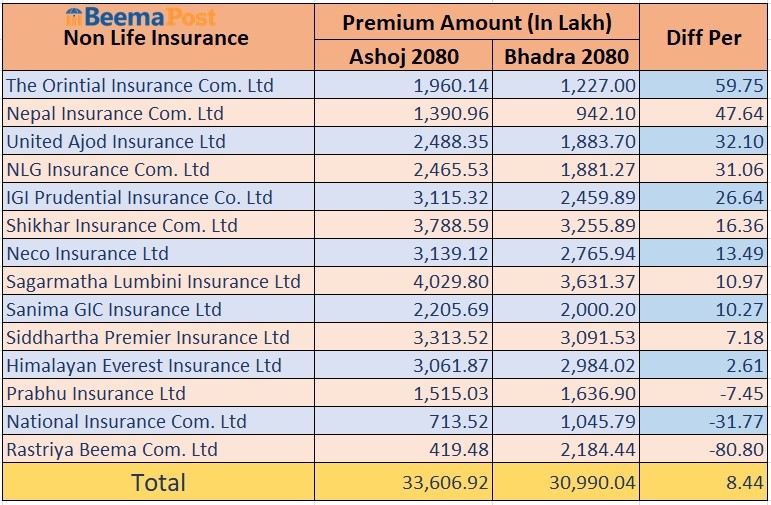

The Premium of Non-Life Insurance Company Increased by 8 Percent in one Month, Decreased by three Percent, what is the Condition of others ?

Kathmandu : Compared to the month of August, the total premium income of non-life insurance companies has decreased by 8 percent. The statistics of the insurance companies show that while the effects of the economic recession are being seen in the banking and financial sector, the insurance companies are also directly affected by it.According to the data of Nepal Insurance Authority, non-life insurance companies have managed to collect premium worth 3.36 billion rupees in the first quarter of the current financial year.During the same period of last month i.e. August, non-life insurance companies collected premiums of 3.9 billion rupees.

Compared to last month, the total insurance fee income of non-life insurance companies has increased by 8 percent.Based on the growth rate :

Looking at the growth rate, the insurance fee income of Oriental Insurance, which is doing insurance business in Nepal as an Indian branch, has increased by 59 percent compared to last month.

In second place is Nepal Insurance Company. The data shows that the total insurance fee income of the company has increased by 47 percent.

United Azod Insurance Company is in the third place. The company’s total insurance fee earnings have increased by 32 percent compared to August.

Decline in insurance business of three companies :

Compared to the month of August, the total premium income of three non-life insurance companies has decreased.

A decline in insurance business from 7 to 80 percent in one month has been seen in non-life insurance companies.

According to the data of Nepal Insurance Authority, compared to the month of August, the largest number of government-owned companies, National Insurance Company, has decreased. 80 percent of the total insurance fee earnings of the company compared to the previous month. It has decreased by 80 percent.

The second is National Insurance Company. The company’s insurance fee income has decreased by 31 percent compared to the previous month.Similarly, the insurance fee income of Prabhu Insurance has decreased by 7 percent compared to the previous month, according to the data published by the Insurance Authority.

Based on the month of OctoberAccording to the monthly data published by the Authority, it has been seen that Sagarmatha Insurance Company has collected the most premiums during this quarter. The company has managed to collect 400 million rupees in premiums in the month of October.

The second is Shikhar Insurance Company. The company has managed to collect premiums of Rs 3788 million in the month of October.

Third is Siddharth Insurance. The company has managed to collect premiums of Rs.33 crore 13 lakh in the month of October.

According to the authority’s data, Neco Insurance Company has managed to earn 313.9 million rupees, IGI Prudential 311.5 million rupees, Himalayan Everest 24 million rupees and United Azod Insurance has managed to earn a total of 248.88 million rupees.

Similarly, NLG Insurance Company Rs.246.5 million, Sanima GIC Rs.225 million, The Oriental Rs.196 million, Prabhu Insurance Rs.155 million, Nepal Insurance Rs.139 million, National Insurance Rs.7 million and National Insurance Company Rs.150 million. They managed to earn a total insurance fee of Rs.4 crores.