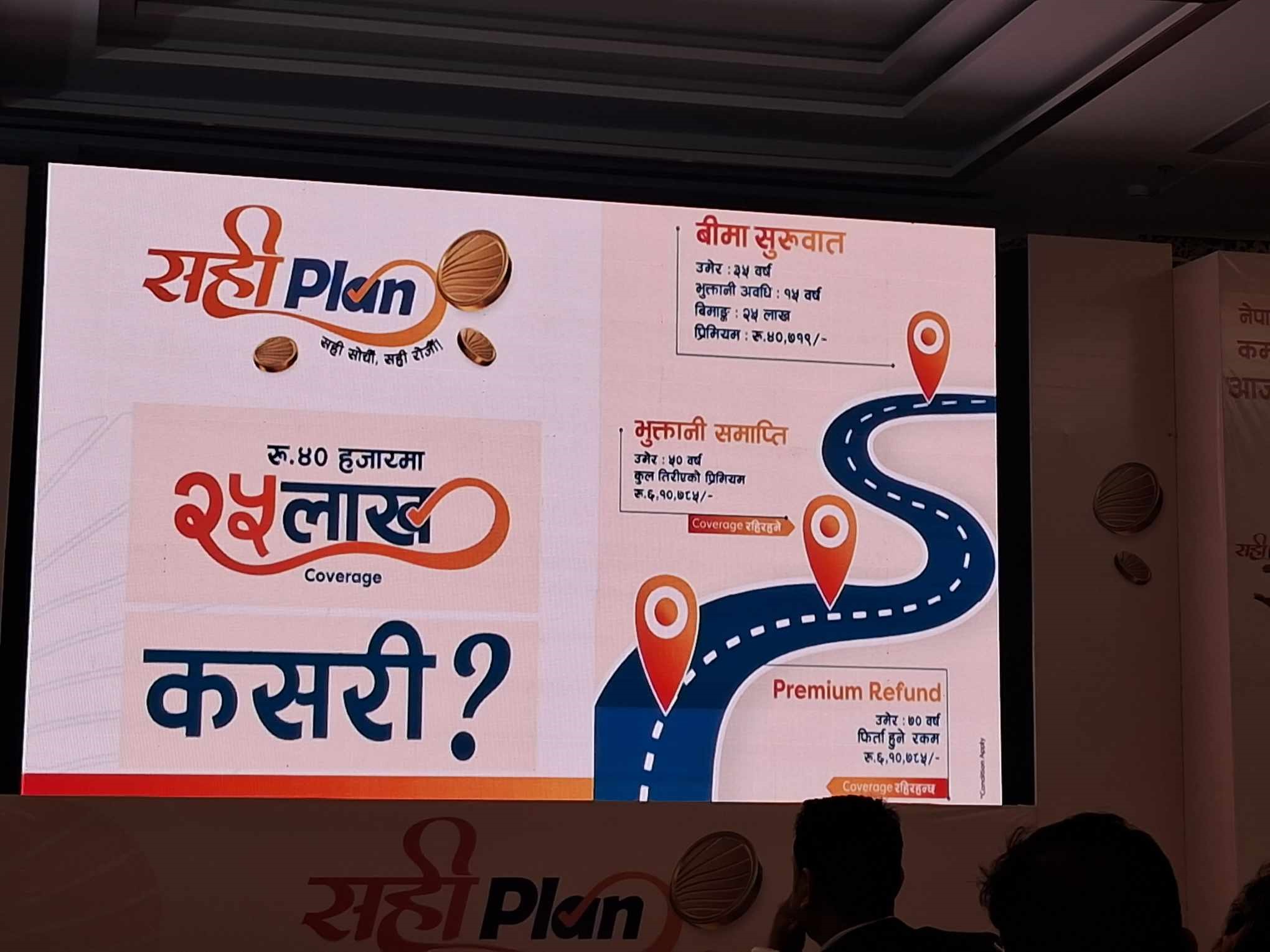

SuryaJyoti Life’s ‘Sahi Plan’ Insurance Policy: Risk Coverage of Rs. 2.5 Million for Rs.40,000

Kathmandu : SuryaJyoti Life has launched a new insurance policy called ‘Sahi Plan’ in the market with the claim that it is the first in Nepal. The insurance premium of Suryajyoti Life’s lifetime term life insurance policy is the cheapest as the company said.

According to the company, the entire amount paid during the insurance period will be refunded after the insured attains the age of 70 years. Similarly, the company has introduced a new insurance policy that carries the risk of up to six times the premium paid for the insurance fee. Officially launching the insurance policy, Surya Prasad Silwal, Chairman of Nepal Insurance Authority, has expressed his belief that the new insurance policy will be successful through study and research.

According to the company, the risk of 2.5 million can be protected by paying 40,000 annual insurance fee in the right plan insurance policy. What are the features of SuryaJyoti Life’s Sahi Plan insurance policy, which has been praised by Surya Prasad Silwal, the Chairman of the Insurance Authority? Listed as below :a) Greater risk protection at lower premiums: SuryaJyoti Life’s “Sahi Plan” insurance policy released on 17th November, 2023 A.D is the only insurance policy in Nepal that carries the highest risk at a low premium.

Since the insurance premium is six times more risk bearing, the insurance policy will be able to bear less premium and more risk. b) Continued risk bearing even after the expiry of the insurance period : The company said that “the Sahi plan” insurance policy is an insurance policy that continues to carry risk even after the insurance period ends. According to the company, whole life risk coverage will be provided even after the insurance period ends. c) Insurance policy with refund of insurance premium : SuryaJyoti Life’s insurance policy named “Sahi Plan”announced on 17th November, 2023 A.D is an insurance policy that refunds the amount of insurance premium.

According to the insurance company, the entire amount paid by the insured for the premium will be returned at the age of 70 years. d) Provisions :1. Minimum Sum Assured: 500 Thousand rupees.2. Minimum entry age: 18 years.3. Maximum entry age: 60 years.4. Age at which maximum premium payment ends: 65 years.5. Minimum Repayment Period: Five years.6. Mode of Insurance Fee Payment: Single/Annual/Half Yearly/Quarterly e) Additional facilities:1. Double insurance benefit in case of accidental death.2. In case of total disability due to accident (up to a maximum of 10 million rupees), insurance fee discount for the remaining period and monthly disability benefits for at least 10 years depending on the insurance.3.

Facility for the treatment of fatal diseases up to 5 million against 35 fatal diseases.4. Loans can be taken at subsidized rates as per rules.