Central Bank suggested to perform transaction keeping interest rate and income transparent

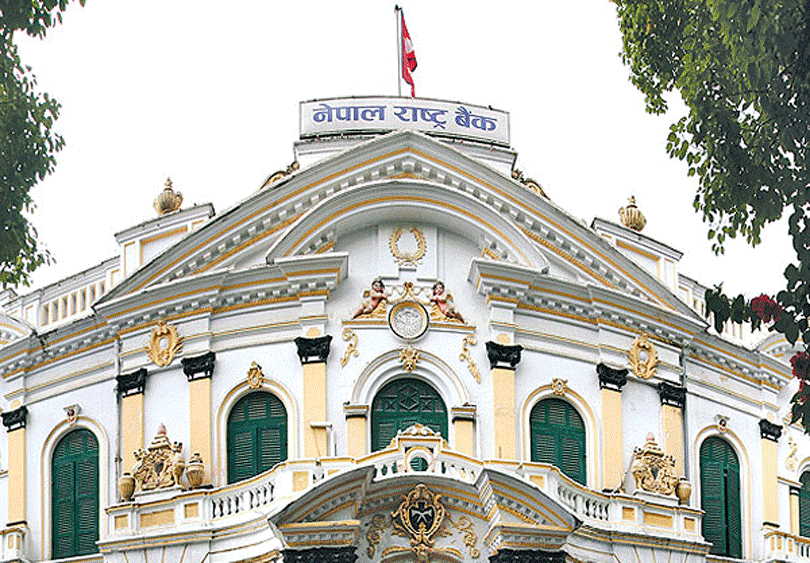

Kathmandu ; Central Bank has suggested to conduct loan transactions in such a way that there is transparency between interest rate and income. The bank issued a notice on 27th of Chaitra and gave this suggestion.

Banks and financial institutions offer various loans such as home loans and vehicle loans targeting different people. According to the bank, the repayment period of such loans is fixed and the interest rate can be variable or fixed.

The bank clarified that the fixed interest rate cannot be changed for the specified period and the variable interest rate can be changed every month according to the change in the base rate and no change can be made in the premium rate.

For people who earn a fixed income on a regular basis, a fixed interest rate helps to balance income and expenses. Therefore, the National Bank has expressed the opinion that the customers must get complete information about the type of interest rate, applicable premium rate and fees applicable to the loan they are going to use.