Life Insurance Agents’ Commission Sees Modest Growth in First Quarter

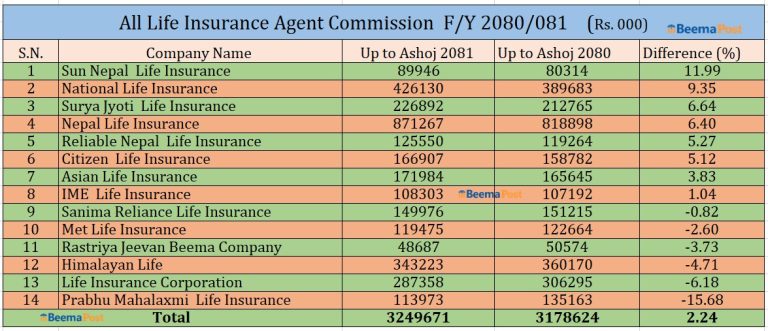

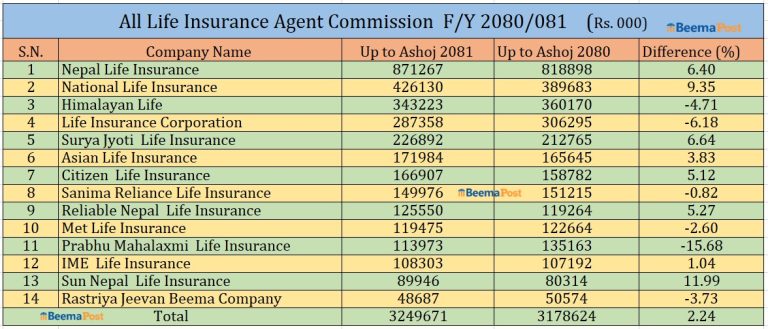

Kathmandu – Life insurance companies in Nepal reported a modest rise in agent commissions during the first quarter of the current fiscal year, reflecting the growing activity and contributions of agents in the industry. The total commission distributed during this period reached Rs 3.24 billion, a 2.24% increase from Rs 3.17 billion in the same period last year.

Agent commissions are a vital source of income for millions of professionals in the sector. These agents play a crucial role by reaching out to villages and settlements, offering insurance solutions, and addressing the challenges faced by citizens. Their efforts significantly contribute to the growth of the life insurance business.

Among the companies, Nepal Life Insurance led in commission distribution, paying Rs 871.12 million to its agents. The company credited this to the diligent efforts of its agents and adherence to policies and regulations. National Life Insurance ranked second, distributing Rs 426.1 million during the same period. While Himalayan Life Insurance paid Rs 343.2 million, it recorded a slight decline in its agent commissions compared to last year.

Other significant contributions included LIC Nepal, which distributed Rs 287.3 million, and SuryaJyoti Life, which paid Rs 226.8 million. Asian Life and Citizen Life followed with Rs 171.9 million and Rs 166.9 million, respectively. Sanima Reliance Life Insurance paid Rs 149.9 million, while Reliable Nepal Life distributed Rs 125.5 million.

The government-owned Rastriya Beema Company paid Rs 48.6 million, and Sun Nepal Life Insurance, despite being one of the smaller contributors with Rs 89.9 million, recorded the highest growth rate in commission payments at 11.99%. National Life Insurance’s commissions grew by 9.35%, while Suryajyoti Life, Nepal Life, Reliable Nepal Life, and Citizen Life also saw increases of up to 6.64%.