Foreign Employment Drives Growth in Nepal’s Term Life Insurance Market

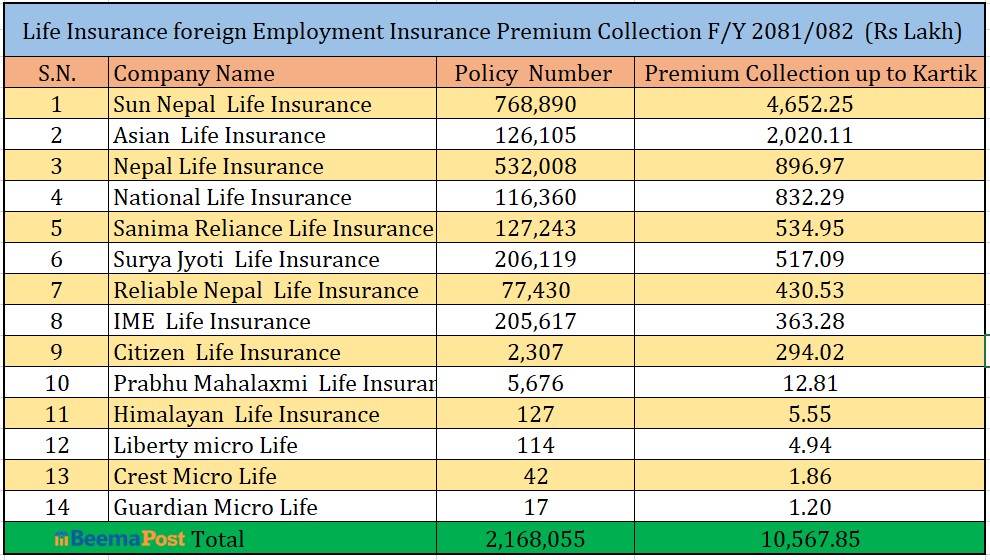

Kathmandu – The scope of term life insurance, mandated by the government, has expanded significantly, driven by the rising number of Nepalese seeking employment abroad due to limited opportunities at home. By the end of Kartik (Mid-November) of the current fiscal year, insurance premiums from foreign employment insurance policies totaled Rs. 1.0567 billion.

This growth was achieved by 11 life insurance companies and three micro life insurance providers operating in Nepal. Leading the market is Sun Nepal Life Insurance, followed by Asian Life and Nepal Life Insurance.

Top Performers in Foreign Employment Insurance

Sun Nepal Life Insurance issued 768,890 policies and earned Rs. 465.2 million in premiums, securing its position as the market leader. The company has been instrumental in safeguarding citizens working abroad.

Asian Life Insurance ranked second, earning Rs. 202 million from 126,105 policies. Nepal Life Insurance, a prominent name in the industry, secured third place with Rs. 89.6 million in premiums from 532,008 policies.

Performance of Other Insurers

National Life Insurance earned Rs. 83.2 million in premiums, while Sanima Reliance Life, SuryaJyoti Life, and Reliable Nepal Life followed with Rs. 53.4 million, Rs. 51.7 million, and Rs. 43 million, respectively.

Smaller insurers, including micro life insurance providers like Liberty Micro Life (Rs. 494,000), Crest Micro Life (Rs. 186,000), and Guardian Micro Life (Rs. 122,000), also contributed to the market.