Policy Surrenders Reach Nearly Rs 5 Billion in Nepal’s Life Insurance Sector

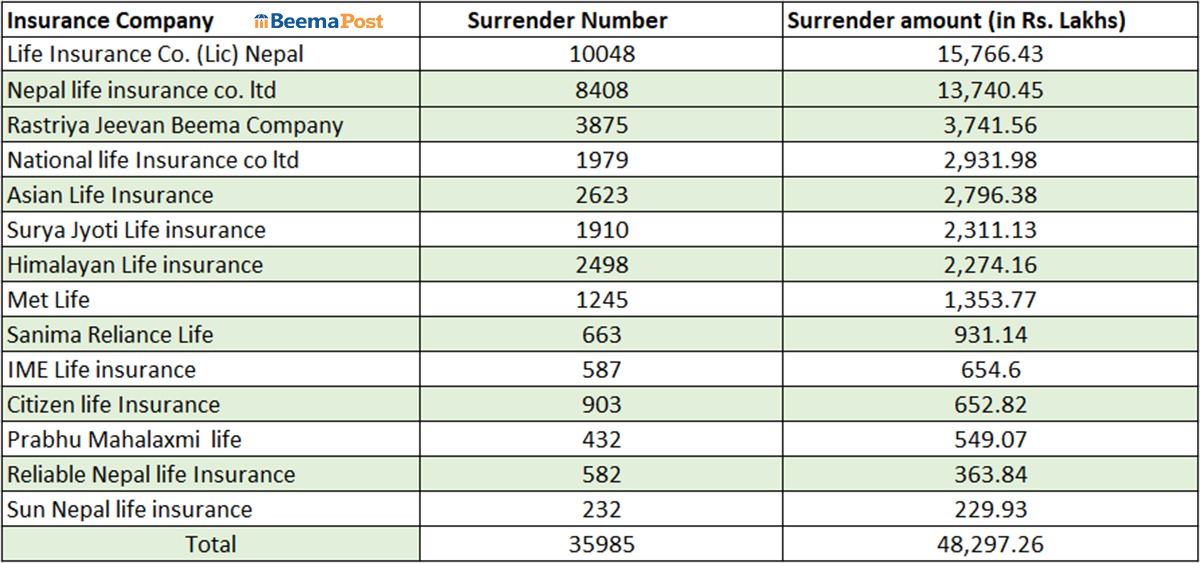

Kathmandu – Nepal’s life insurance sector has reported a significant rise in policy surrenders, with total terminations reaching nearly Rs 5 billion by the end of the Kartik month (Mid-November) of the current fiscal year. According to the Nepal Insurance Authority, a total of 35,985 policies were surrendered across 14 life insurance companies, amounting to Rs 4.82 billion.

LIC Nepal recorded the highest number of policy surrenders, with 10,048 policies worth Rs 1.57 billion terminated during this period. Nepal Life Insurance followed closely, with 8,408 policies worth Rs 1.37 billion surrendered.

Government-owned Rastriya Jeevan Beema Company also faced significant surrenders, with policies worth Rs 374.1 million terminated. Similarly, National Life Insurance reported surrenders valued at Rs 293.1 million, while Asian Life Insurance and SuryaJyoti Life Insurance saw policy terminations worth Rs 279.6 million and Rs 231.1 million, respectively.

Other companies also saw a significant surrenders, with Himalayan Life surrendering policies worth Rs 227.4 million and Met Life seeing surrenders amounting to Rs 135.3 million. Sanima Reliance, IME Life, and Citizen Life recorded surrenders valued at Rs 93.1 million, Rs 65.2 million, and Rs 65.4 million, respectively. Meanwhile, Prabhu Mahalaxmi Life surrendered policies worth Rs 54.9 million, Reliable Nepal Rs 36.3 million, and Sun Nepal Rs 22.9 million.

The surge in surrenders reflects ongoing challenges in public awareness and trust in insurance. Despite the growing presence of life insurance companies, the increase in policy surrenders highlights that the Government of Nepal is still struggling to promote proper insurance literacy, and insurance agents have been unable to effectively convince policyholders to retain their policies.