Insurance Companies in Nepal Hold NPR 744 Billion in Investments, Majority in Fixed Deposits

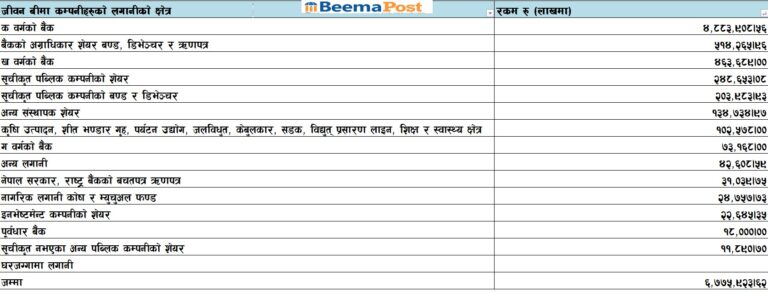

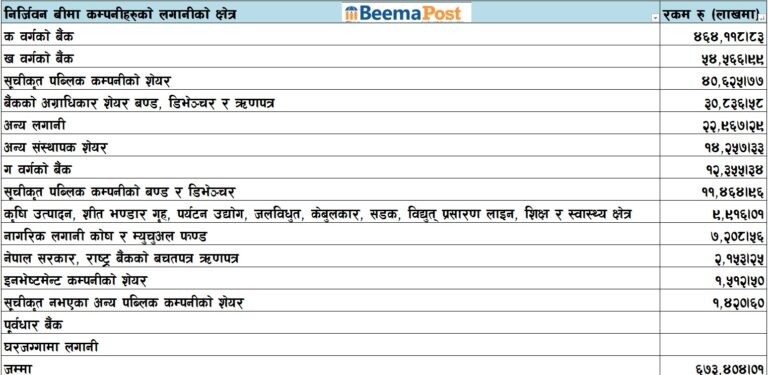

Kathmandu – Insurance companies in Nepal have collectively invested NPR 744 billion in various sectors, with a significant portion placed in bank fixed deposits. Of this, life insurance companies account for NPR 677 billion, while non-life insurance companies have invested over NPR 67.34 billion.

The Nepal Insurance Authority (NIA) data for the first quarter of the current fiscal year reveals that life insurance companies have invested 80.27% of their total funds—approximately NPR 543.87 billion—in fixed deposits at commercial, development, and finance banks. Notably, MetLife Insurance has allocated 94.27% of its total investments in fixed deposits.

Among the 14 life insurance companies, Nepal Life Insurance holds the largest portfolio at NPR 174.56 billion, with 90.11% of it (NPR 157.30 billion) in fixed deposits at commercial and development banks. LIC Nepal follows, with 84.09% of its NPR 103.44 billion portfolio invested in fixed deposits, primarily in commercial banks.

MetLife Insurance, notable for its conservative strategy, has invested a staggering 94.27% of its total funds in fixed deposits. Collectively, life insurance companies have deposited NPR 488.39 billion in commercial banks, NPR 46.36 billion in development banks, and NPR 7.31 billion in finance companies. Additionally, NPR 1.80 billion has been invested in Nepal Infrastructure Bank by companies such as National Life, SuryaJyoti Life, and Citizen Life.

Non-life insurance companies have invested 79% of their total funds, equivalent to NPR 53.10 billion, in fixed deposits. This includes NPR 46.41 billion in class-A commercial banks, NPR 5.45 billion in class-B development banks, and NPR 1.23 billion in class-C financial institutions.

In addition to fixed deposits, non-life companies have invested in bonds, debentures, and treasury bills, amounting to NPR 3.08 billion. Other investments include NPR 2.28 billion in miscellaneous sectors and NPR 991.6 million in agriculture, tourism, hydropower, and renewable energy projects. However, the total investments in these alternative sectors remain negligible compared to bank deposits.

Despite the NIA’s guidelines (Second Amendment) 2080 BS, encouraging diversification into sectors such as real estate, hydropower, tourism, and renewable energy, both life and non-life insurance companies have shown minimal interest in these areas. Life insurance companies have made no investments in real estate, and non-life companies have yet to explore infrastructure banks.