The Billion Rupee Question: Nepal Life’s Investments

Kathmandu – Nepal Life Insurance Company (Nepal Life), a dominant player in Nepal’s life insurance industry, continues to solidify its leading position not only commercially but also financially. With a robust paid-up capital of Rs 8.2 billion, the company has demonstrated remarkable financial stability, reflected in its Rs 711.9 million retained earnings and Rs 1.1 billion allocated to the disaster fund by the end of the first quarter of the current fiscal year.

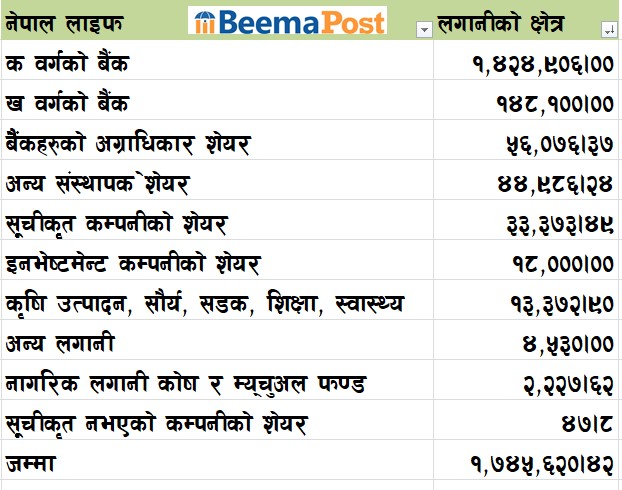

Nepal Life has consistently prioritized investments that ensure the safety and security of its policyholders. As of the first quarter, the company has invested an impressive Rs 174 billion across various sectors, with a particular focus on fixed deposits with banks and financial institutions.

A closer look at the data released by the Nepal Insurance Authority reveals that Nepal Life has allocated Rs 157 billion exclusively to fixed deposits, the majority of which are in Class A banks, amounting to Rs 142 billion. Class B banks received Rs 14.81 billion in investments.

In addition to fixed deposits, the company has diversified its investment portfolio. It has allocated Rs 5.6 billion to preference shares of banks, Rs 4.49 billion to other promoter shares, and Rs 3.33 billion to shares of listed companies. Investments in agriculture, manufacturing, solar energy, infrastructure, education, and health collectively amount to Rs 1.33 billion, reflecting Nepal Life’s dedication to supporting sectors critical to national development. Other notable investments include Rs 1.8 billion in shares of investment companies, Rs 453 million in various other investments, Rs 222.7 million in citizens’ investment trust and mutual funds, and Rs 4.7 million in shares of unlisted companies.

Nepal Life’s investment strategy, heavily weighted towards secure and stable sectors, reinforces the strength and reliability of Nepal’s insurance industry. By maintaining a balanced approach that adheres to regulatory limits while ensuring optimal returns, the company has set a benchmark for the industry, offering both policyholders and stakeholders a sense of security and confidence.