Life Insurance Companies Earn Rs 65.74 Billion in Premiums, Marking 6.47% Growth

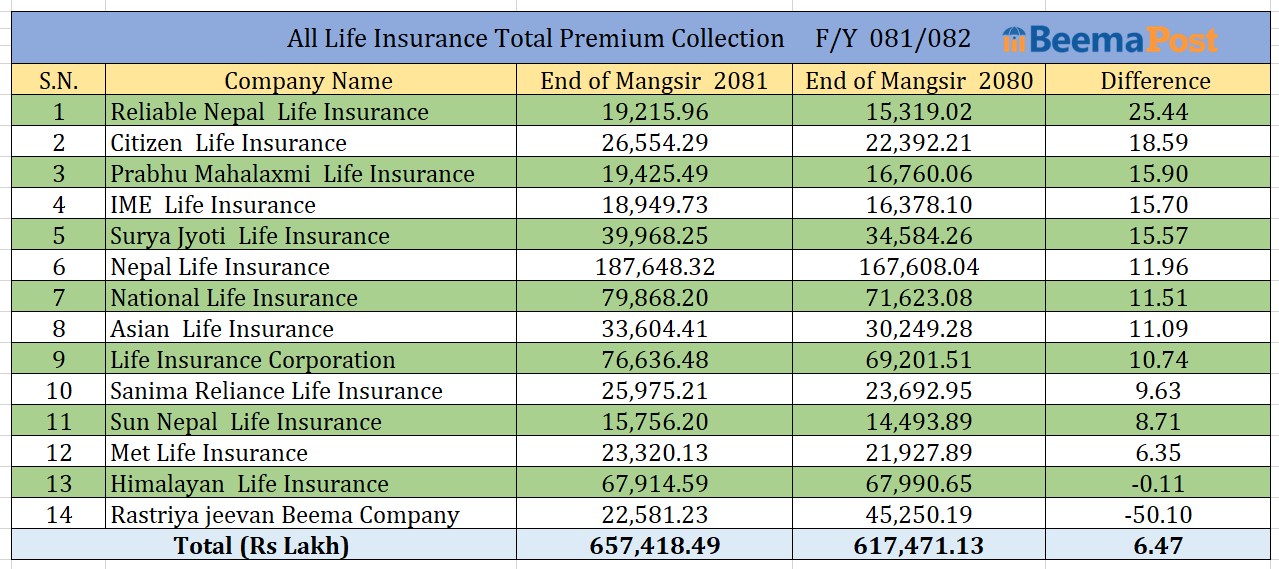

Kathmandu – Nepal’s life insurance sector has recorded a total insurance premium income of Rs 65.74 billion by the end of Mangsir (Mid-December) in the current fiscal year, reflecting a 6.47% growth compared to Rs 61.74 billion collected in the same period last fiscal year, according to data from the Nepal Insurance Authority.

Nepal Life Insurance leads the industry with a premium income of Rs 18.76 billion, a growth of 11.96%. National Life Insurance follows with Rs 7.98 billion, up by 11.51% from the previous year’s Rs 7.16 billion. LIC Nepal ranks third, collecting Rs 7.66 billion, a 10.74% increase from Rs 6.92 billion. Himalayan Life Insurance secured the fourth position with Rs 6.79 billion in premiums.

In terms of business growth, Reliable Nepal Life Insurance saw the most significant increase, with premiums rising by 25.44% to Rs 1.92 billion. Citizen Life also showed impressive growth, with an 18.59% increase to Rs 2.65 billion.

Other notable performers include Prabhu Mahalaxmi Life (15.90%), IME Life (15.70%), Suryajyoti Life (15.57%), and Asian Life (11.09%). Meanwhile, Sanima Reliance Life grew by 9.63%, Sun Nepal Life by 8.71%, and MetLife by 6%.

However, not all companies saw positive trends. The government-owned Rastriya Jeevan Beema Company experienced a sharp 50% decline in premium income, marking the steepest drop in the sector.