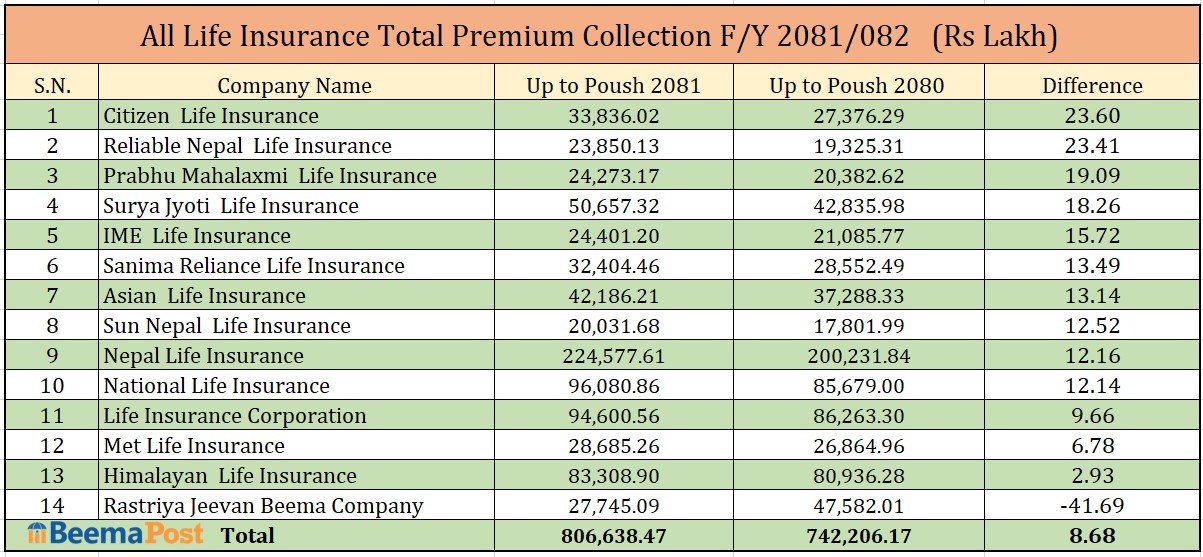

Life Insurance Sector Grows by 8%; Nepal Life Leads, Citizen and Reliable Show Remarkable Growth

Kathmandu – Nepal’s life insurance sector experienced an 8% growth in the first six months of the current fiscal year 2081/082, with 14 companies collectively earning NPR 80.66 billion in insurance premiums. According to data released by the Nepal Insurance Authority on Wednesday, the industry has shown steady progress, with Nepal Life Insurance and National Life Insurance emerging as the leading contributors, while Citizen Life and Reliable Nepal Life achieved the highest growth rates.

Nepal Life Insurance retained its top position by generating NPR 22.45 billion in insurance premiums, reflecting a 12.16% increase compared to the previous fiscal year. National Life Insurance secured the second spot, with its premium income rising by 12.14% to NPR 9.6 billion. LIC Nepal also showed notable progress, earning NPR 9.46 billion, marking a 9.66% growth, while Himalayan Life Insurance’s premium income grew modestly by 2.93% to NPR 8.33 billion.

Among the other players, SuryaJyoti Life Insurance stood out with an 18.26% increase, earning NPR 5.06 billion. Asian Life Insurance followed closely, recording a 13.14% rise in premiums to NPR 4.21 billion. Citizen Life demonstrated the most significant growth rate in the sector, with its premium income soaring by 23.60% to NPR 3.38 billion. Reliable Nepal Life also delivered an impressive performance, achieving a 23.41% growth to reach NPR 2.03 billion.

Sanima Reliance Life’s premium income climbed by 13.49% to NPR 3.24 billion, while IME Life Insurance earned NPR 2.44 billion, marking a growth rate of 15.72%. Prabhu Mahalaxmi Life registered a 19.09% increase, collecting NPR 2.42 billion, while Sun Nepal Life grew by 12.52%, earning NPR 2 billion in premiums. MetLife Nepal also saw an increase in premium income, rising by 6.78% to NPR 2.06 billion.

Despite the overall growth of the sector, the government-owned Rastriya Jeevan Beema Company faced challenges, reporting a 41% decline in premium income, which stood at NPR 2.77 billion during this period.