Insurance Companies Delay Payment of Claims from Floods and Landslides

Kathmandu – Out of the total insurance claims amounting to Rs 12.78 billion from the devastating floods and landslides triggered by incessant rains in last September 2024, non-life insurance companies have paid only Rs 2.5 billion so far. This leaves Rs 9.87 billion in claims unpaid, creating significant hardships for the insured.

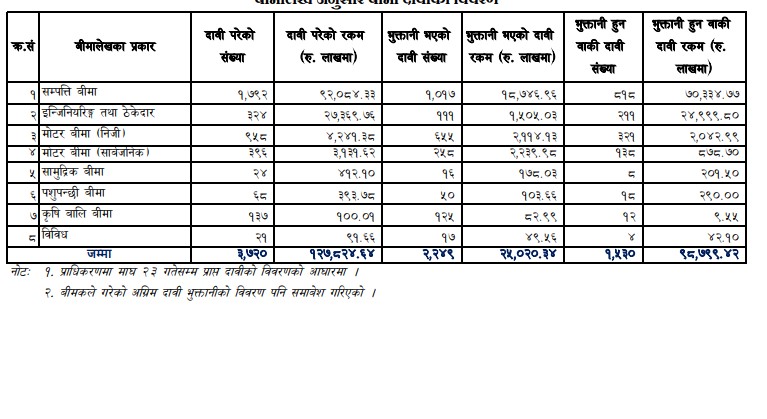

According to the Nepal Insurance Authority, a total of 3,720 claims were filed following the natural disaster. Of these, insurance companies have settled 2,249 claims, while 1,530 claims remain unresolved. The authority has instructed insurers to expedite payments and submit damage reports weekly, but delays persist.

The data shows that the highest losses occurred in property insurance, with claims totaling Rs 9.2 billion. Of this, only Rs 1.87 billion has been paid, leaving over Rs 7 billion unpaid. Similarly, for engineering and contractor insurance, Rs 150 million has been paid out of Rs 2.73 billion, while Rs 2.49 billion remains outstanding. Motor insurance claims also face delays, with Rs 210 million paid out of Rs 424.1 million for private vehicles and Rs 220 million out of Rs 310 million for public vehicles still pending.

Non-Life Insurance

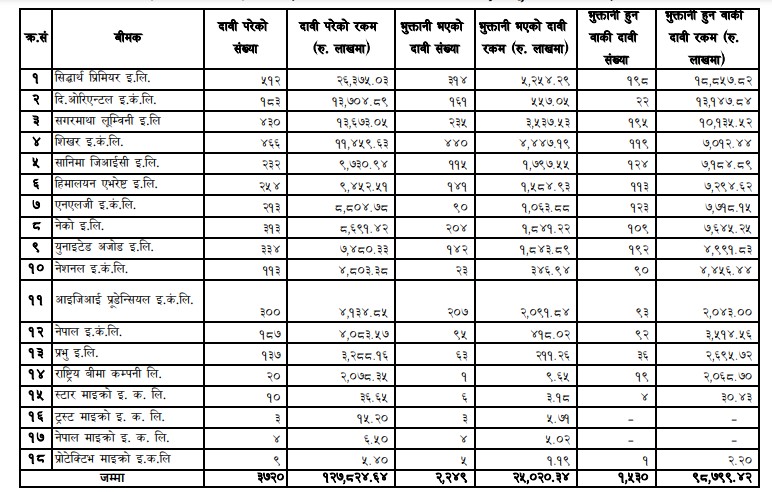

Among non-life insurers, Siddhartha Premier Insurance Company has settled the highest number of claims. The company received claims worth Rs 2.63 billion and has paid Rs 525.4 million for 314 claims, but Rs 1.8 billion for 198 claims remains unpaid. Shikhar Insurance received Rs 1.14 billion in claims and has paid Rs 444.7 million for 440 claims, while 119 claims are still unsettled. Sagarmatha Insurance has faced criticism for its delays, having paid only Rs 350 million out of Rs 1.36 billion in claims, leaving Rs 1 billion for 19 claims unpaid.

Micro Insurance

In the micro insurance sector, Star Micro Insurance has paid Rs 300,000 for six claims but still owes Rs 300,000 for four claims. Protective Micro Insurance has settled five claims for Rs 119,000 but has yet to pay Rs 220,000 for one claim. Trust Micro Insurance and Nepal Micro Insurance have paid all claims.

The delay in settling claims, even five months after the disaster, has left many insured individuals and businesses in distress. The Nepal Insurance Authority has urged companies to prioritize timely settlements to alleviate the burden on affected policyholders.