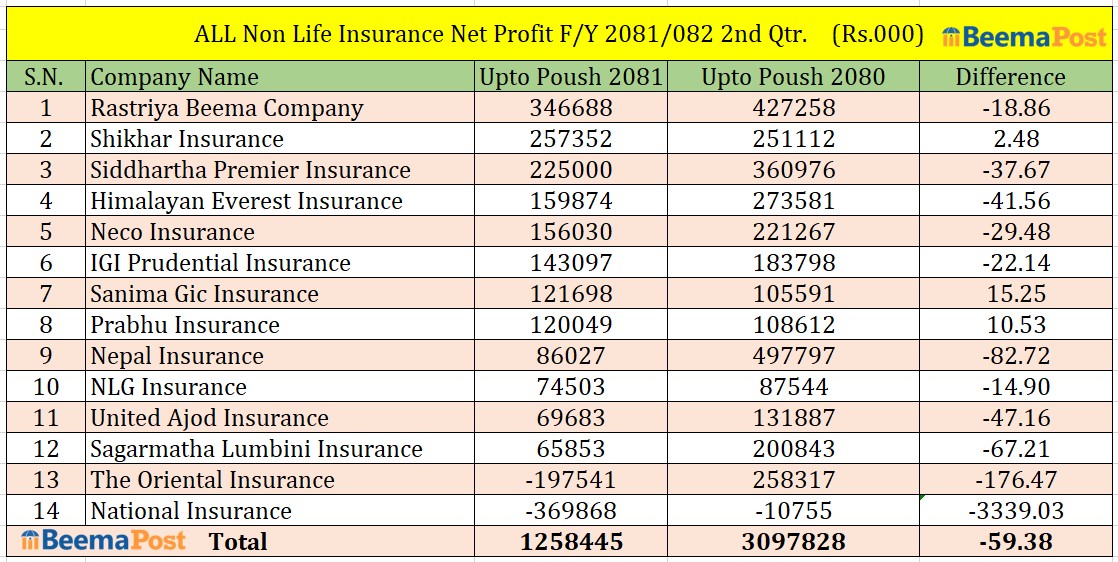

Non-Life Insurance Companies Report 59.38% Decline in Profit; Sanima GIC Leads Growth Rate

Kathmandu – The combined profit of 14 non-life insurance companies in Nepal has dropped significantly by 59.38% in the second quarter of the current financial year. According to the financial statements published by these companies, their collective net profit stood at Rs 1.25 billion, a sharp decline from Rs 3.9 billion recorded during the same period last year.

The review period highlights a challenging phase for most non-life insurance companies , with only a few managing to report profit growth. Sanima GIC Insurance emerged as the top performer in terms of growth rate, recording a 15.25% increase in net profit compared to last year. The company earned Rs 121.6 million during the quarter. Prabhu Insurance followed with a 10.53% rise in profit, totaling Rs 120 million, while Shikhar Insurance posted a modest 2.48% growth with a net profit of Rs 257.3 million.

However, the majority of the companies saw a decline in profitability. Rastriya Beema Company, despite ranking high in earnings, experienced a negative 18.86% drop in net profit, falling from Rs 427.2 million to 346.6 million. Similarly, Siddhartha Premier Insurance earned Rs 225 million, Himalayan Everest Insurance Rs 159 million, and Neco Insurance Rs 156 million, all reporting reduced profits compared to the previous year.

IGI Prudential Insurance earned a net profit of Rs 143 million, while Nepal Insurance, which struggled with an 82.71% profit decline earlier, recorded Rs 86 million. NLG Insurance posted Rs 74.5 million, United Azod Insurance Rs 60 million, and Sagarmatha Lumbini Insurance Rs 65.8 million.

Two companies, however, reported losses in the second quarter of the year. The Oriental Insurance suffered a loss of Rs 197.5 million, while National Insurance recorded a significant loss of Rs 369.8 million, marking the most severe setbacks among the non-life insurers.

The overall financial results reveal that among the 14 companies, only three – Sanima GIC, Prabhu Insurance, and Shikhar Insurance managed to increase their profits, while nine companies saw a decline, and two reported losses.