Deposits and Loans Surge in Commercial Banks During First Seven Months of FY 2081/82

Kathmandu – The first seven months of the current fiscal year 2081/82 have witnessed significant growth in both deposits and loan disbursements by commercial banks in Nepal. According to data published by the Nepal Bankers Association, deposit collections increased by Rs 242 billion, while loan disbursements rose by Rs 256 billion during this period.

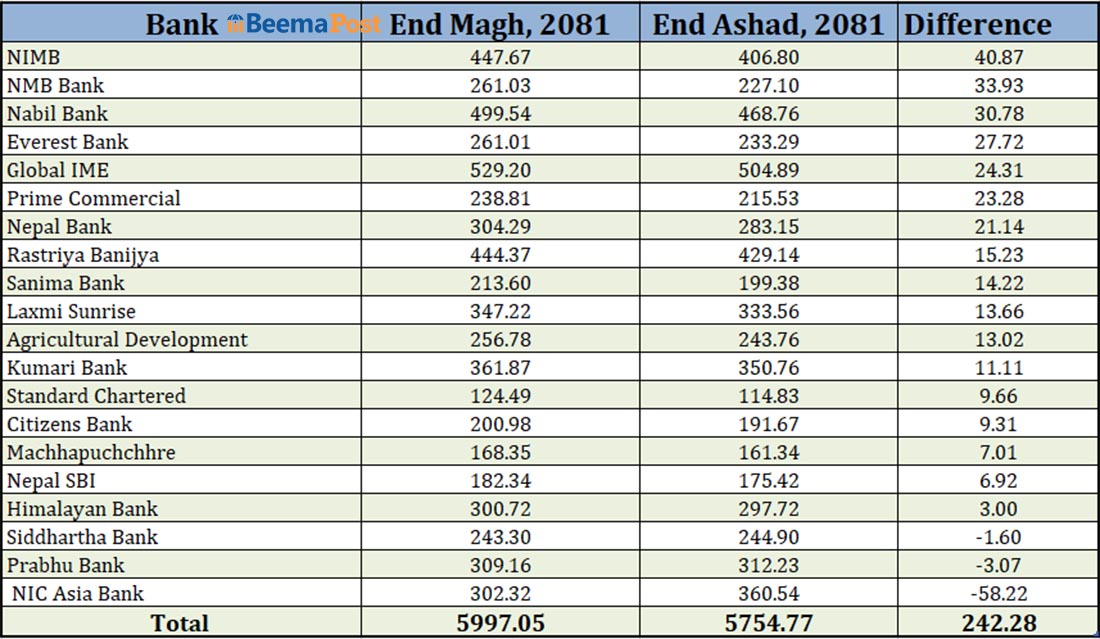

At the end of the last fiscal year 2080/81, commercial banks had collected Rs 575.4 billion in deposits. By the end of the month of Magh of the current fiscal year, the deposit amount had surged to Rs 599.7 billion.

Global IME Bank led the deposit collection, increasing its deposits by Rs 24.31 billion to reach Rs 529.20 billion. Nabil Bank followed with an increase of Rs 30.78 billion, bringing its total deposits to Rs 499.54 billion. Nepal Investment Mega Bank was also aggressive in deposit collection, raising Rs 40.87 billion to reach Rs 447.67 billion.

Several other banks also saw notable increases in deposit collection during this period. Rastriya Banijya Bank collected Rs 15.23 billion, Kumari Bank Rs 11.11 billion, Laxmi Sunrise Bank Rs 13.66 billion, Nepal Bank Rs 21.14 billion, Himalayan Bank Rs 3 billion, NMB Bank Rs 33.93 billion, Everest Bank Rs 27.72 billion, Agricultural Development Bank Rs 13.02 billion, Prime Commercial Bank Rs 23.28 billion, Sanima Bank Rs 14.22 billion, Citizens Bank Rs 9.31 billion, Nepal SBI Bank Rs 6.92 billion, Machhapuchhre Bank Rs 7.01 billion, and Standard Chartered Bank Rs 9.66 billion.

However, deposits at NIC Asia Bank decreased by Rs 58 billion, Prabhu Bank by Rs 3 billion, and Siddhartha Bank by Rs 1.60 billion.

In terms of loan investments, commercial banks expanded their credit portfolios by Rs 2.56 billion, reaching Rs 442.7 billion by the second quarter of the current fiscal year, up from Rs 45.7 billion at the end of the previous fiscal year.

Global IME Bank topped the list in loan investments, increasing its credit investment by Rs 40.57 billion in nine months. Everest Bank followed closely, investing Rs 34.32 billion during the same period. NMB Bank invested Rs 27.46 billion, Nabil Bank Rs 23.48 billion, Laxmi Sunrise Bank Rs 22.98 billion, Nepal Investment Mega Bank Rs 22.64 billion, Rastriya Banijya Bank Rs 21.75 billion, Prime Commercial Bank Rs 18.99 billion, Nepal Bank Rs 16.28 billion, Siddhartha Bank Rs 13.02 billion, Machhapuchhre Bank Rs 12.58 billion, and Sanima Bank Rs 11,56 billion in loan disbursements.

Meanwhile, NIC Asia Bank saw its loan investment decrease by Rs 32.88 billion, Standard Chartered Bank by Rs 3.79 billion, and Prabhu Bank by Rs 1.58 billion.