Life Insurance Companies in Nepal Sees Growth in Solvency Ratio in Q2 of Current Fiscal Year

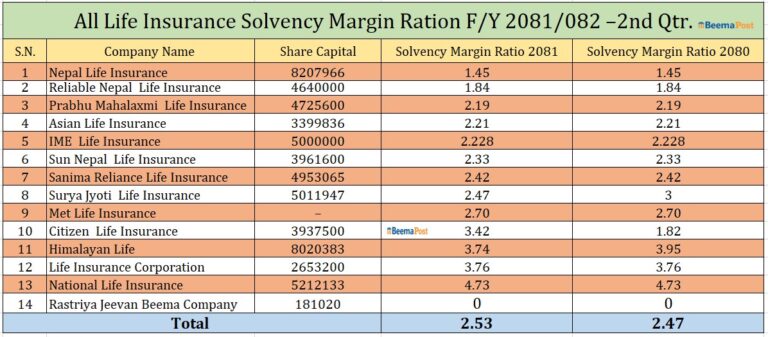

Kathmandu – The solvency ratio of life insurance companies in Nepal has reached 2.53 in the second-quarter of current fiscal year. According to the financial statements published by life insurance companies, there has been a slight increase on solvency ratio from last year’s average of 2.47.

Among the 14 life insurance companies operating in Nepal, National Life Insurance holds the highest solvency ratio at 4.73, making it the most financially secure insurer in the country. Following closely behind, LIC Nepal maintains a solvency ratio of 3.76, the same as last year, securing its position as the second safest company. Himalayan Life Insurance ranks third with a solvency ratio of 3.74, although it has slightly declined from 3.95 in the previous year.

Another company showing notable growth is Citizen Life Insurance, which saw its solvency ratio rise significantly from 1.82 last year to 3.42 this year. On the other hand, MetLife Insurance has maintained its previous solvency ratio of 2.70, while SuryaJyoti Life experienced a drop from 3.0 to 2.47. Sanima Reliance Life Insurance recorded a solvency ratio of 2.42, unchanged from last year.

Sun Nepal Life Insurance and IME Life Insurance have also maintained their previous solvency ratios of 2.33 and 2.22, respectively. Similarly, Asian Life Insurance reported a ratio of 2.21, while Prabhu Mahalakshmi Life Insurance stood at 2.19, Reliable Nepal Life Insurance at 1.84, and Nepal Life Insurance at 1.45, making it the company with the lowest solvency ratio.

Rastriya Jeevan Beema Company’s solvency ratio remains at 0 as the company has not disclosed its reason for not being audited for quite some time. Despite some fluctuations among individual companies, the overall solvency ratio of Nepal’s life insurance sector remains well above the regulatory requirement. The Insurance Authority mandates a minimum solvency ratio of 1.5, and the industry’s current average of 2.53 demonstrates strong financial health.

The rise in solvency ratios can be attributed to the impact of the Regulatory Insurance Authority’s decision to increase the paid-up capital requirements for life insurance companies. According to insurance expert Bhojraj Sharma, a solvency ratio of 2.53 reflects a robust and stable insurance sector in Nepal. He emphasized that the ratio, which measures the relationship between a company’s liabilities and assets, is a key indicator of financial strength. “The higher the solvency ratio, the stronger the company,” Sharma stated.