Non-Banking Assets of Commercial Banks Surge by 79.89% in Seven Months

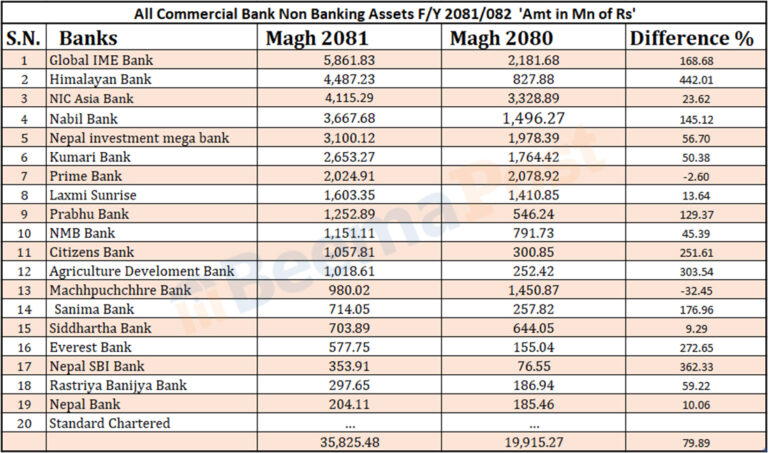

Kathmandu – The non-banking assets (NBAs) of commercial banks in Nepal have increased significantly, rising by 79.89% in the first seven months of the current financial year. According to Nepal Rastra Bank, the total NBAs of commercial banks reached Rs. 35.82 billion in Seven months, compared to Rs. 19.91 billion during the same period last year.

Non-banking assets refer to properties acquired by banks after failing to recover loans through auctions. The rise in NBAs indicates that banks are struggling to recover loans and are forced to take ownership of these assets, creating challenges in financial management and cash flow.

Global IME Bank holds the highest amount of NBAs among commercial banks, with an increase of 168.68% to Rs. 5.86 billion, up from Rs. 2.18 billion in the same period last year. Himalayan Bank follows with NBAs of Rs. 4.48 billion.

Other notable increases include NIC Asia Bank, whose NBAs grew by 23.62% to Rs. 4.11 billion, and Nabil Bank, which saw a rise of 145.12% to Rs. 3.66 billion. Nepal Investment Mega Bank’s NBAs increased by 56.70% to Rs. 3.10 billion, while Kumari Bank’s rose by 50.38% to Rs. 2.65 billion. Prime Bank, however, reported a 2.60% decline, with NBAs standing at Rs. 2.02 billion.

Among other banks, Lakshmi Sunrise’s NBAs rose by 13.64% to Rs. 1.6 billion, Prabhu Bank’s by 129% to Rs. 1.25 billion, NMB Bank’s by 45.39% to Rs. 1.15 billion, Citizens Bank’s by 251.61% to Rs. 1.05 billion, and Krishi Bikas Bank’s by 303.54% to Rs. 1.01 billion. The remaining seven banks have NBAs below Rs. 1 billion.