Bagmati Province Tops Non-Life Insurance Market, Motor Insurance Leads the Sector

Kathmandu – Non-life insurance companies operating in Nepal have earned a total insurance premium of Rs 28.6 billion during the first eight months of the current fiscal year. This includes from 14 non-life insurance companies and four non-life microinsurance companies.

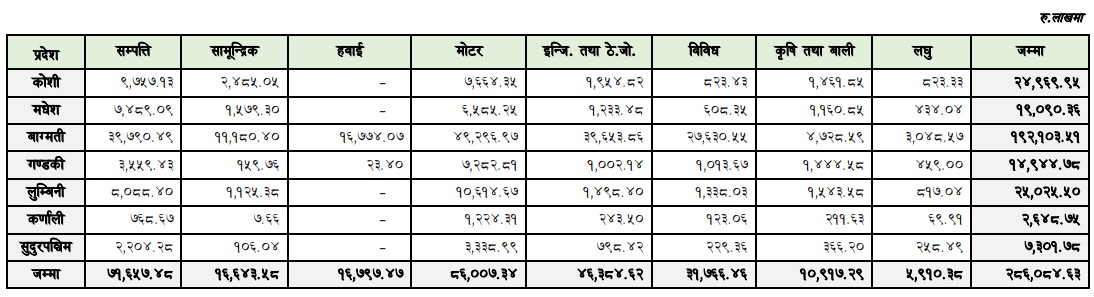

Motor insurance remains the largest source of revenue for non-life insurers, contributing Rs 8.6 billion in premiums. Property insurance follows closely, generating Rs 7.16 billion during the same period. Engineering and contract risk insurance accounted for Rs 4.63 billion, while aviation insurance added Rs 1.67 billion to the total premium income.

Marine insurance contributed Rs 1.66 billion, while agriculture and crop insurance accounted for Rs 1.9 billion. Additionally, microinsurance premiums amounted to Rs 3.17 billion, with an additional Rs 591 million coming from other microinsurance-related business.

Bagmati Province continues to dominate the non-life insurance market, being a federal capital and a hub for motor and property businesses. Non-life insurers generated Rs 19.21 billion in premiums from Bagmati Province alone, accounting for more than 60 percent of the total business.

Lumbini Province and Koshi Province followed with insurance premium collections of Rs 2.5 billion and Rs 2.49 billion, respectively. In contrast, Karnali Province, which is geographically distant from the federal capital and has lower business activity, generated the least insurance premiums, totaling Rs 264.8 million.