Commercial Banks Earn Rs 42.75 Billion in Eight Months, Nabil Bank Tops the Chart

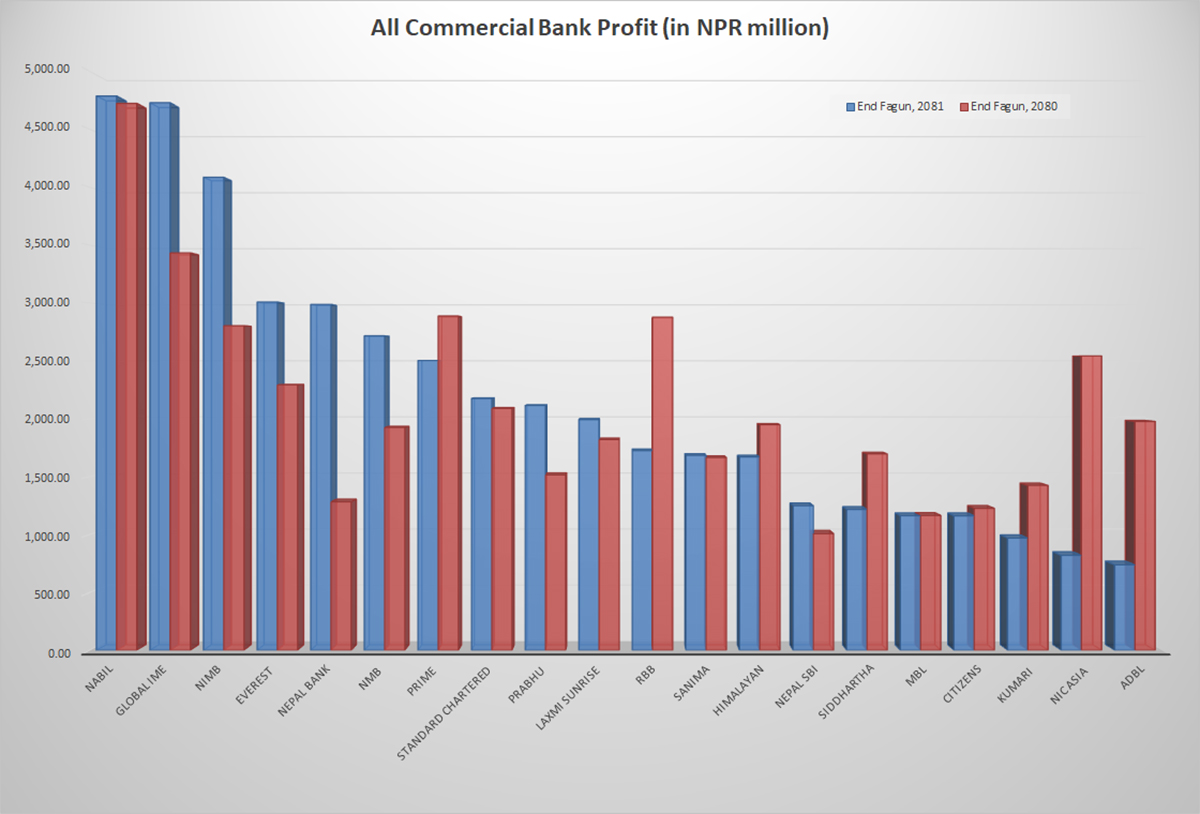

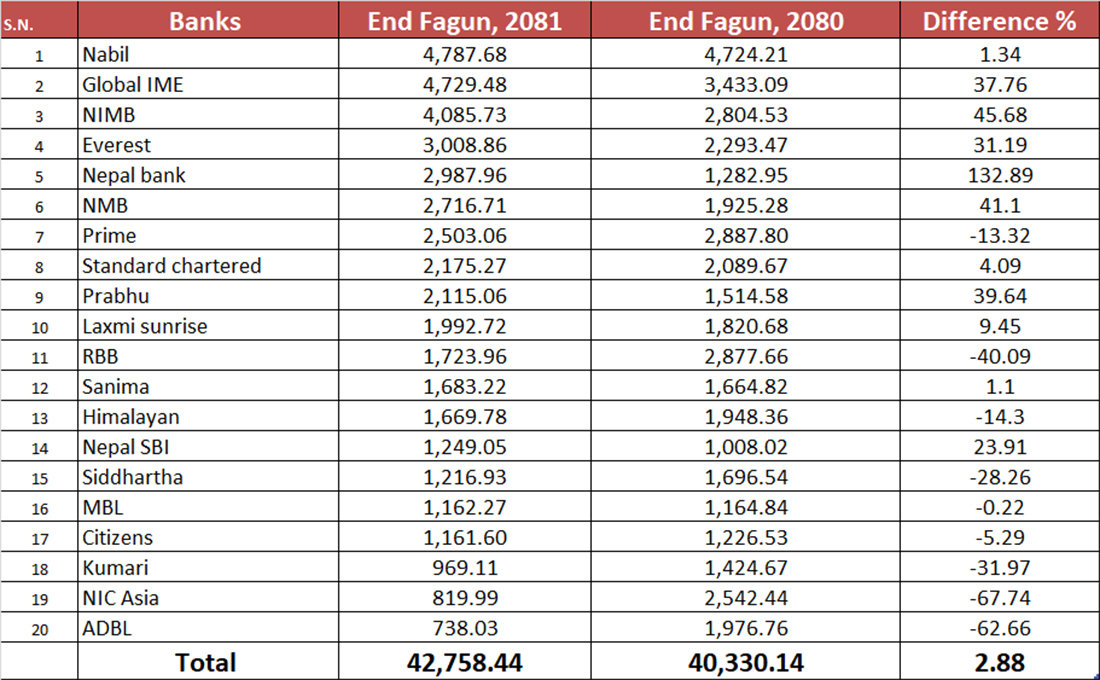

Kathmandu – The 20 commercial banks operating in Nepal have collectively earned a profit of Rs 42.75 billion by the end of Falgun in the current fiscal year 2080/81. According to data released by Nepal Rastra Bank, this marks a 2.88 percent increase compared to the same period last fiscal year, when the profit stood at Rs 40.33 billion.

Nabil Bank has retained its position as the highest profit-earning commercial bank. In the eight months under review, it posted a profit of Rs 4.78 billion, reflecting a modest growth of 1.34 percent compared to the Rs 4.72 billion it earned during the same period last year.

Following closely, Global IME Bank recorded the second-highest profit, earning Rs 4.72 billion with a notable increase of 37.76 percent. Nepal Investment Mega Bank stood third, posting a strong profit growth of 45.68 percent to reach Rs 4.08 billion. Everest Bank secured the fourth spot with a profit of Rs 3.08 billion, marking a 31.19 percent rise, while Nepal Bank registered a remarkable growth of 132 percent, earning Rs 2.98 billion during the period. NMB Bank also demonstrated significant progress, with its profit reaching Rs 2.71 billion, an increase of 41.1 percent.

Among other major banks, Prime Bank reported a decline in profit by 13.32 percent, with earnings standing at Rs 2.50 billion. Standard Chartered Bank, however, showed a marginal increase of 4.09 percent, recording Rs 2.17 billion in profit. Prabhu Bank posted a 39.64 percent rise to Rs 2.11 billion, while Laxmi Sunrise Bank recorded a 9.45 percent increase to Rs 1.99 billion. Rastriya Banijya Bank, on the other hand, saw its profit plunge by 40.09 percent to Rs 1.72 billion.

Sanima Bank’s profit raised up slightly by 1.1 percent to Rs 1.68 billion, while Himalayan Bank experienced a 14.3 percent decline, earning Rs 1.66 billion in the eight-month period.

Other banks also contributed to the total sectorial earnings, with Nepal SBI Bank earning Rs 1.24 billion, Siddhartha Bank Rs 1.21 billion, and both Machhapuchhre Bank and Citizen Bank each reporting Rs 1.16 billion in profit. Kumari Bank posted Rs 969.1 million, NIC Asia Bank earned Rs 819.9 million, and Agricultural Development Bank recorded Rs 738.03 million in profit.

Despite the overall growth, the data reveals a mixed performance among the banks, with 10 institutions reporting a decline in profits while 11 managed to increase their earnings.