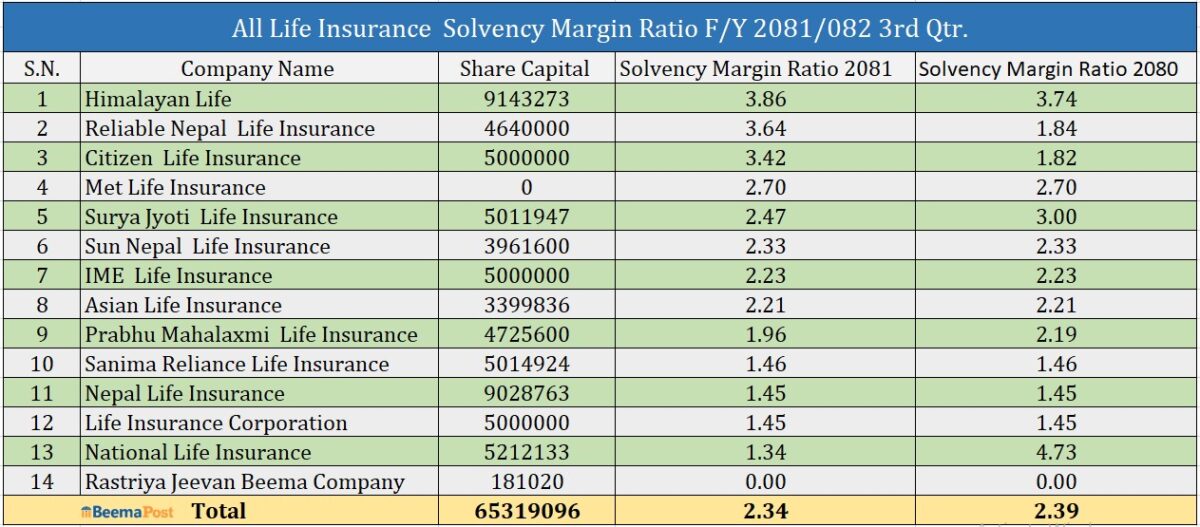

Life Insurance Solvency Ratio Stands at 2:39, Himalayan Life Tops the Solvency Chart

Kathmandu – Despite a slight dip in the average solvency ratio, Nepal’s life insurance sector continues to demonstrate strong financial health, with most companies maintaining a capacity well above the regulatory requirement. The third quarter financial reports of the ongoing fiscal year show the average solvency ratio of life insurers stands at 2.34 which is just below last year’s 2.39.

Among the 14 life insurance companies in operation, Himalayan Life Insurance has emerged as the most financially secure, reporting the highest solvency ratio at 3.86. Reliable Nepal Life Insurance follows closely with a ratio of 3.64, showing notable growth from the previous year. Both companies are regarded as having high risk-bearing capacity, reflecting robust financial stability.

Citizen Life Insurance ranks third with an impressive jump in its solvency ratio from 1.82 last year to 3.42 this year. Meanwhile, MetLife maintained a steady solvency ratio at 2.70. SuryaJUyoti Life Insurance, however, saw a slight decrease from 3.00 to 2.47, while Sun Nepal Life remained unchanged at 2.33.

IME Life Insurance recorded a ratio of 2.23, also unchanged from the previous year. Asian Life Insurance and Prabhu Mahalaxmi Life Insurance reported solvency ratios of 2.23 and 1.96, respectively. Sanima Reliance Life remained constant at 1.46.

Nepal Life and LIC Nepal each reported a solvency ratio of 1.45, while National Life Insurance stands at the lowest among peers with 1.34. Notably, National Life has yet to disclose reasons for the prolonged absence of an audit report.

According to regulations set by the Insurance Authority, life insurance companies are required to maintain a minimum solvency ratio of 1.5. Despite a few companies falling short, the overall industry average of 2.34 indicates sound financial standing.