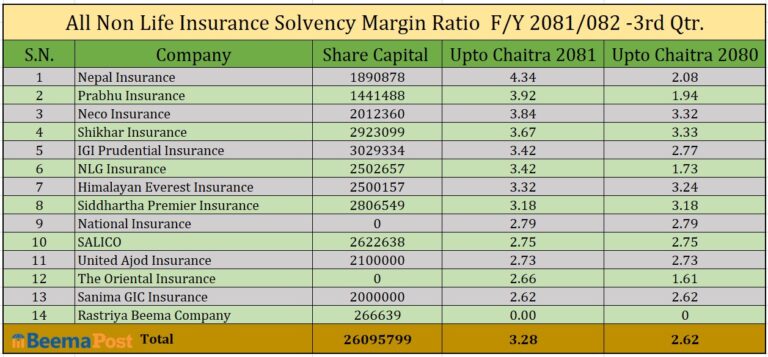

Non-Life Insurance Companies in Nepal Solvency Ratio Records 3.28 in Q3 of Curreny FY

Kathmandu – The average solvency ratio of Nepal’s non-life insurance companies has shown a modest improvement in the second quarter of the current fiscal year, reaching 3.28-up from last year’s 2.62. This improvement reflects the overall financial strength of the sector, which remains well above the minimum regulatory requirement of 1.5 set by the Insurance Authority.

Among the 14 non-life insurance companies currently in operation, Nepal Insurance has emerged as the most financially secure, boasting a solvency ratio of 4.34. Prabhu Insurance follows closely with a ratio of 3.92, marking a slight improvement compared to the previous fiscal year.

IGI Prudential Insurance and NLG Insurance have both reported a solvency ratio of 3.42, placing them among the top performers. Notably, NLG Insurance saw a significant year-on-year increase.

Himalayan Everest Insurance also demonstrated progress, improving its solvency ratio to 3.32. Siddhartha Premier Insurance recorded a ratio of 3.18, showing no year-on-year change.

On the mid-range of the spectrum, National Insurance and Sagarmatha Lumbini Insurance reported solvency ratios of 2.79 and 2.75, respectively, with both companies recording no changes from the previous fiscal year. United Ajod Insurance stands at 2.73, while The Oriental Insurance and Sanima GIC Insurance reported identical ratios of 2.62.

The government-owned Rastriya Beema Company did not report its solvency status due to a lack of updated audit data.