Outstanding Insurance Claims of Non-Life Insurance Companies Records Rs 35.79 Billion in Q3

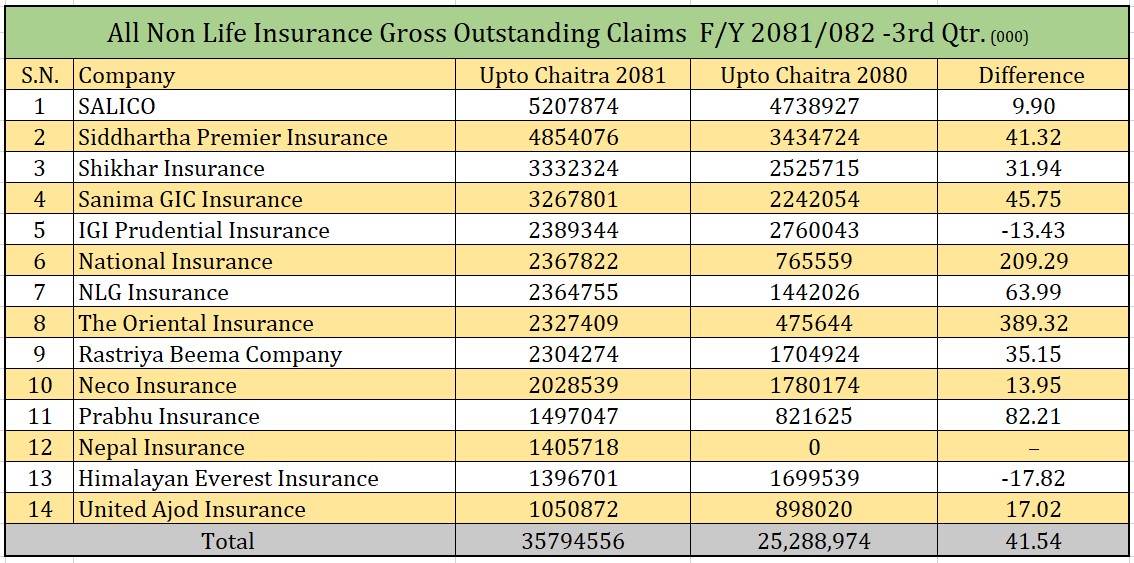

Kathmandu — The total outstanding insurance claim amount of Nepal’s non-life insurance sector has reached Rs 35.79 billion by third quarter of of the current fiscal year. This figure marks a 41.54 percent increase compared to the same period last year.

According to the third-quarter financial reports published by the companies, 14 non-life insurance providers operating in Nepal had a collective outstanding claim amount of Rs 25.28 billion during the review period of the previous fiscal year.

Sagarmatha Lumbini Insurance has topped the list with the highest unpaid claim amount. As of chaitra-end, its outstanding claims have risen by nine percent to Rs 5.20 billion. In the same period last year, the company’s claim liabilities stood at Rs 4.73 billion.

Following closely, Siddhartha Premier Insurance has posted an outstanding claim amount of Rs 4.85 billion, which is a sharp 4.32 percent increase compared to the previous year.

Shikhar Insurance and Sanima GIC Insurance reported outstanding amounts of Rs 3.33 billion and Rs 3.26 billion respectively. IGI Prudential Insurance recorded claims amounting to Rs 2.38 billion.

The figures further reveal that both National Insurance and NLG Insurance have outstanding claim amounts of around Rs 2.36 billion. The Oriental Insurance follows with Rs 2.32 billion. The state-owned Rastriya Beema Company has liabilities totaling Rs 2.30 billion.

Neco Insurance’s pending claims stand at Rs 2.02 billion, while Prabhu Insurance and Nepal Insurance are at Rs 1.497 billion and Rs 1.405 billion respectively.

On the lower end of the spectrum, Himalayan Everest Insurance and United Ajod Insurance have reported the smallest outstanding claim figures. Himalayan Everest’s unpaid claims total Rs 1.39 billion, and United Ajod’s amount stands at Rs 1.05 billion.