Scam by SuryaJyoti Life on the name of “Child Insurance policies” that do not bear the insured’s risk

Kathmandu : It has been revealed that SuryaJyoti Life Insurance Company has been selling erroneous policies. In the documents received by “Beemapost”, it has been revealed that Suryajyoti Life has been selling and distributing children’s insurance policies contrary to the basic principles of insurance. The company has sold hundreds of child insurance policies so far.

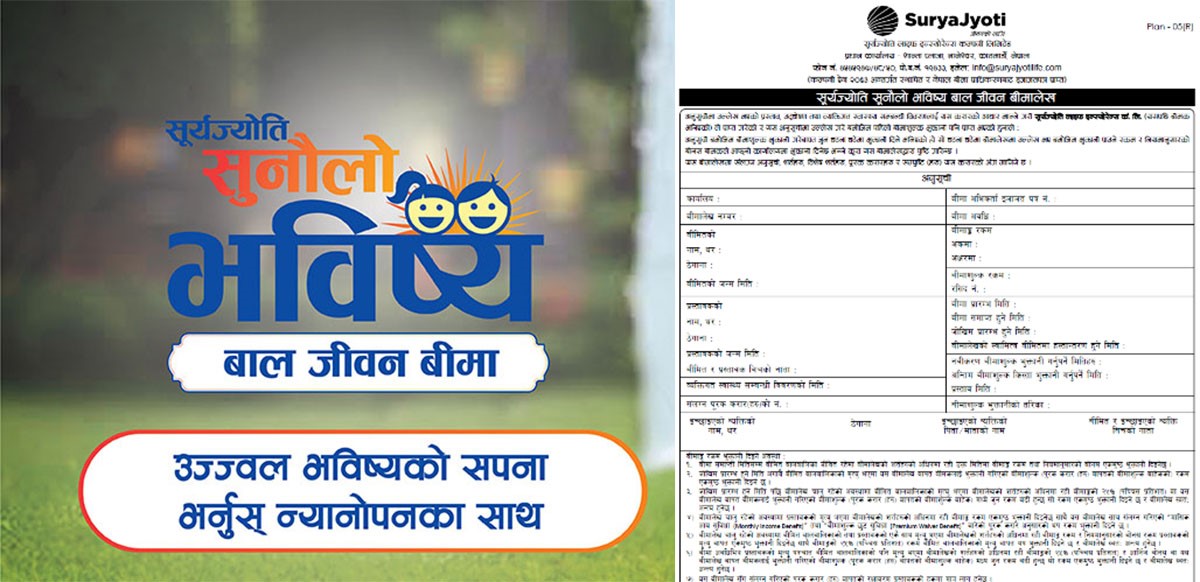

It has been found that only 25 percent of the insured’s risk or the paid insurance premium is covered in the “Sunaulo Bhabisya Baal Jeevan Bima Policy” which is currently being sold by SuryaJyoti Life Insurance. According to the basic principles of insurance, 100 percent risk of the insured should be protected. However, if the insured children die due to any reason in the child insurance policy of SuryaJyoti Life, they will not get the sum assured. They will get only 25% of the total or premium paid whichever is higher and the insurance policy will automatically terminate.

Experts in the insurance sector say that an insurance policy that does not bear the risk of the death of the insured cannot be an insurance policy. However, SuryaJyoti Life is selling and distributing insurance policies that do not cover the risk of the insured, contrary to the basic principles of insurance, value recognition.

It is clearly stated in the condition no. 3 of SuryaJyoti’s “Sunaulo Bhabisya Baal Jeewan Beema” insurance which is being sold and distributed with the approval of Nepal Insurance Authority, that “If the insured child dies after the date of commencement of the policy while the policy is in force, 25 (twenty-five percent) of the sum insured will be subject to the terms of the policy or this policy. The insurance premium paid to the Insurer (excluding insurance premiums for supplementary contract(s)) whichever is greater will be paid and the policy will automatically terminate.”

Similarly, condition no. 2 states that “if the insured child dies before the risk begins, the insured will receive the amount according to the contract, i.e. only 25 percent of the risk will be borne and the policy will terminate automatically”. Whereas according to the Insurance Act, it is mentioned that insurance will be taken to bear the risk of the insured. However, contrary to the Insurance Act and the general principle of insurance, SuryaJyoti Life is cheating the public by selling and distributing insurance policies that do not assume the risk of the insured.

In that policy, if the parents of the insured who propose to insure the children other than the insured die, then 100% risk is assumed. It is mentioned in condition no. 4 of the same policy that the insurance policy does not bear the risk of the insured but if the proposer of the insured dies then it will bears 100% risk. Similarly, in condition No. 5, if the insured and the proposer die together, the proposer will get 100 percent of the insured amount and 25 percent of the insured amount for the death of the insured children. According to the insurance policy, even the insured children will not get the benefit related to the supplemental contract, only the proposer will get it.

An insurance agent admitted that insurance policies sold are in very small print that the insured could not understand due to which they were given very little information when insuring thier children with this policy. “We cannot say that the risk is only 25 percent, but we are selling because we have a policy given by the company, the letters are small and it is not possible to see everything but even after taking the policy those client has not come to us about complaining anything,” the agent told to beemapost.

Information officer of the company, Umesh Mainali, did not want to be contacted regarding the sale and distribution of insurance policies that did not cover the risk of the insured.

There seems to be big scam or any mislead in this new policy “Sunaulo Bhabisya Jeewan Beema” lunched by SuryaJyoti Life insurance as this insurance doesn’t cover the 100% insurance in case of the death of insured which is against the insurance rules. But this policy says that it will claim 25% only which is very awkward and difficult to understand.