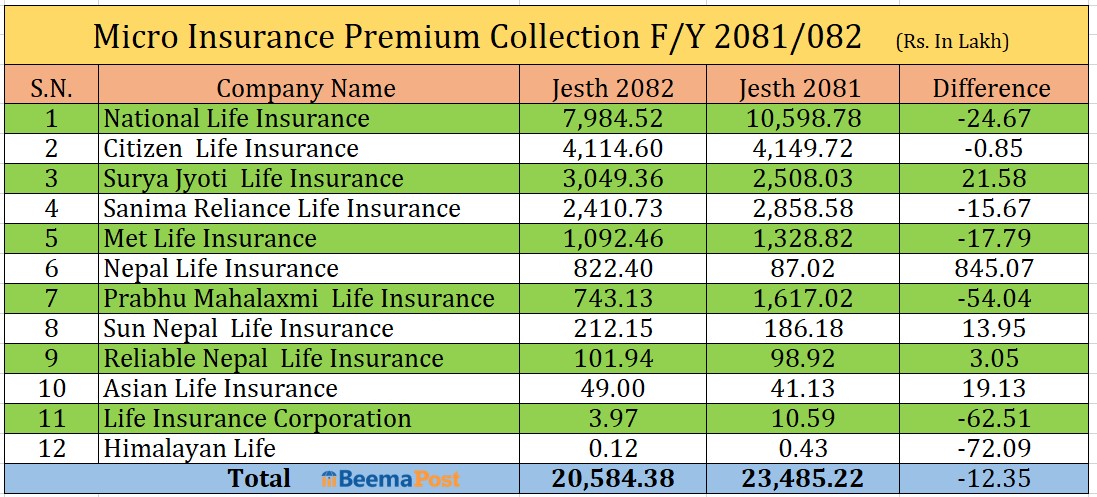

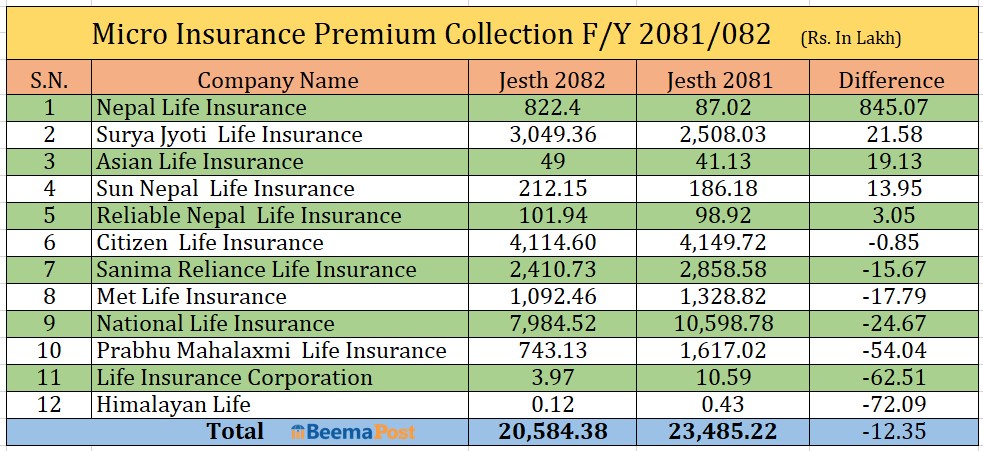

Micro Insurance Business of Life Insurance Companies in Nepal Reaches Rs 2.05 Billion

Kathmandu — Life insurance companies operating in Nepal have collectively conducted micro insurance business worth Rs 2.05 billion by end of Jestha (mid-April to mid-June) of the current fiscal year, according to the latest data published by the Nepal Insurance Authority. A total of 12 life insurance companies engaged in micro insurance reported this revenue, marking a modest increase from last year’s figure of Rs 2.34 billion.

While the overall volume suggests stability, the business has shown a year-on-year decline of 12.35 percent when compared to the same period of the previous fiscal year. However, not all companies followed the same trend.

National Life Insurance emerged as the top performer, registering the highest micro insurance business at Rs 798.45 million. Citizen Life Insurance followed with Rs 411.4 million, while Suryajyoti Life Insurance made significant gains with Rs 304.9 million. Sanima Reliance Life Insurance recorded Rs 241.1 million, MetLife Nepal stood at Rs 109.2 million, and Nepal Life Insurance reported Rs 82.2 million in micro insurance premiums.

Other companies also contributed to the total: Prabhu Mahalaxmi Life Insurance earned Rs 74.3 million, Sun Nepal Life Rs 21.1 million, Reliable Nepal Life Rs 11.1 million, and Asian Life Insurance Rs 4.9 million. LIC Nepal and Himalayan Life Insurance reported the smallest amounts, with LIC Nepal earning Rs 300,000 and Himalayan Life just Rs 12,000.

Interestingly, microinsurance companies experienced a remarkable surge in business. The three micro life insurers operating in the country recorded a combined business of Rs 657.6 million, marking a 395.23 percent rise from Rs 132.7 million in the same period last fiscal year.

Guardian Micro Life Insurance led the pack with Rs 266.8 million in business, followed closely by Crest Micro Life Insurance with Rs 252.6 million. Liberty Micro Life Insurance secured Rs 138.2 million.