Deposits and Loans of Commercial Banks Increase in Eight Months

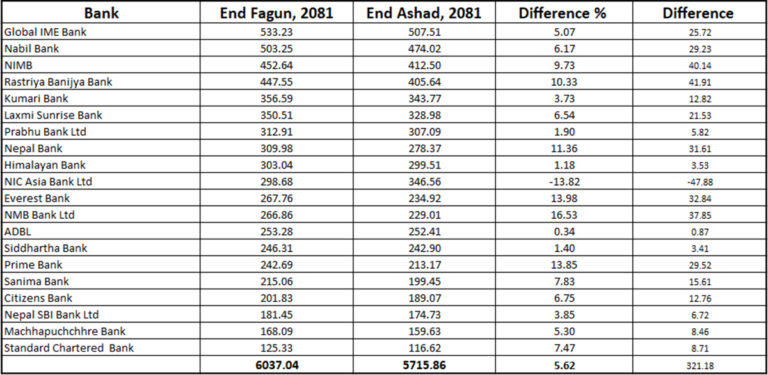

Kathmandu – Commercial banks in Nepal have witnessed a notable rise in both deposits and loans during the first eight months of the current fiscal year 2081/82. According to data from the Nepal Bankers Association, deposit collection increased by 5.62%, while lending grew by 6.12% during the period.

As of the end of month of Ashar (mid-July, 2024) 2080/81, commercial banks had collected a total of Rs 5.715 trillion in deposits. By the end of Magh (mid-February, 2025) of the current fiscal year, this figure had risen to Rs 6.037 trillion.

Top Performers in Deposit Collection

Global IME Bank recorded the highest deposit growth, increasing by 5.07% to Rs 533.23 billion. Nabil Bank’s deposits rose by 6.17% to Rs 503.25 billion, while Nepal Investment Mega Bank showed aggressive growth with a 9.73% increase, reaching Rs 452.64 billion.

Other notable deposit figures include Krishi Bikas Bank at Rs 253.2 billion, Citizens Bank at Rs 201.83 billion, Everest Bank at Rs 267.76 billion, Himalayan Bank at Rs 303.04 billion, Kumari Bank at Rs 356.59 billion, Lakshmi Sunrise Bank at Rs 350.51 billion, Machhapuchhre Bank at Rs 168.09 billion, and Nepal Bank at Rs 309 billion.

Loan Disbursement

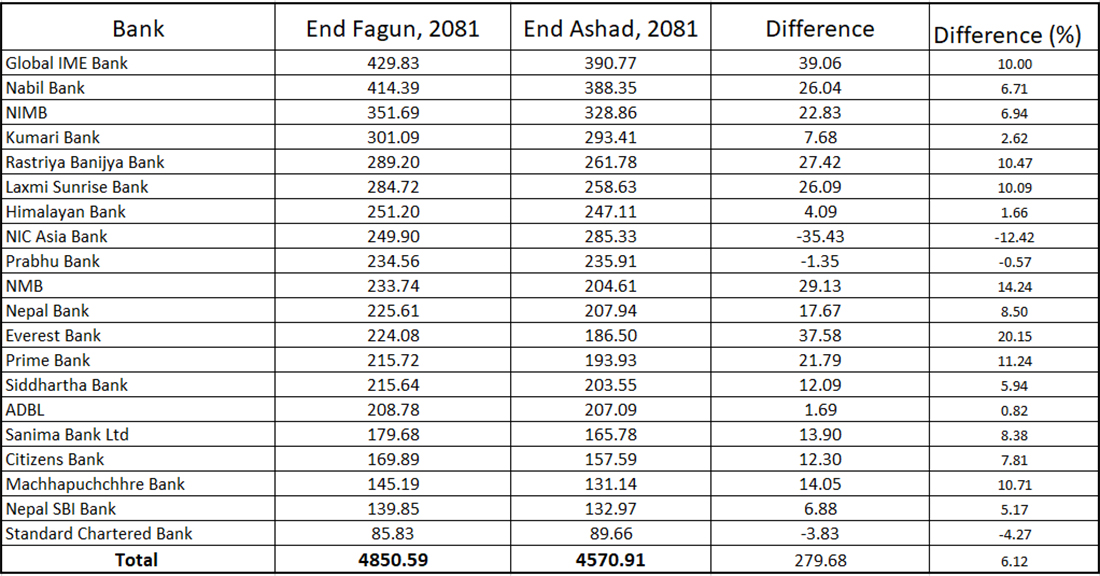

Credit investment by commercial banks rose by 6.12% to Rs 4.85 trillion by the eighth month of the fiscal year, compared to Rs 4.50 trillion in the previous year.

Global IME Bank led in loan investment, increasing by Rs 39.06 billion (10%) to Rs 429 billion. Everest Bank’s loan disbursement saw a 20% rise, adding Rs 37.58 billion to reach Rs 224.08 billion.

Other banks also reported significant increases: NMB Bank’s loans rose by Rs 29.13 billion, Rastriya Banijya Bank by Rs 27.42 billion, Lakshmi Sunrise Bank by Rs 26.9 billion, Nabil Bank by Rs 26.4 billion, Nepal Investment Mega Bank by Rs 22.83 billion, and Prime Bank by Rs 21.79 billion.

Nepal Bank’s loan flow increased by Rs 17.67 billion, Machhapuchhre Bank by Rs 14.5 billion, Sanima Bank by Rs 13.9 billion, Citizens Bank by Rs 12.3 billion, Siddhartha Bank by Rs 12.9 billion, Kumari Bank by Rs 7.68 billion, Nepal SBI Bank by Rs 6.83 billion, and Himalayan Bank by Rs 4.9 billion.

Decline in Loan Investment

Despite the overall growth, some banks saw a decline in loan disbursement. NIC Asia Bank’s loan flow decreased by Rs 35.43 billion, Standard Chartered Bank by Rs 3.83 billion, and Prabhu Bank by Rs 1.35 billion.