Surge in Personal Home Loans, Banks Compete with Attractive Schemes

Kathmandu – The demand for personal housing loans in Nepal has surged significantly, with citizens increasingly turning to banks to fulfill their dreams of owning homes. After years of slowdown, the housing loan segment is showing signs of revival, energizing the construction industry and contributing to broader economic activity.

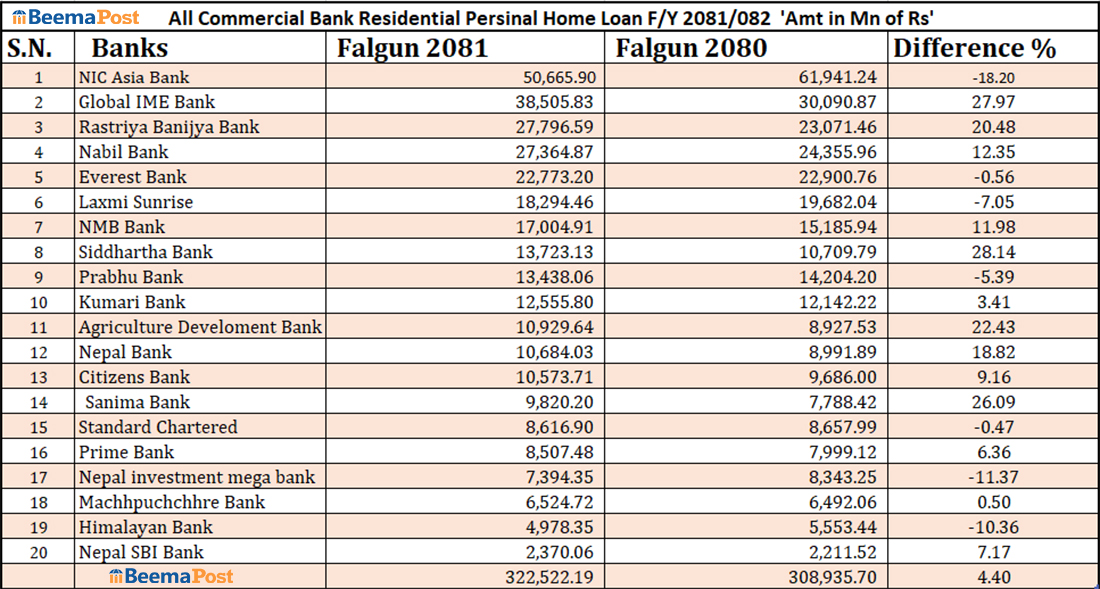

Commercial banks and financial institutions have ramped up investments in personal housing, driven by favorable monetary policies and competitive lending schemes. According to data, banks have disbursed Rs 322.52 billion in home loans during the first eight months of the current fiscal year — a 4.40% rise compared to the same period last year.

The Nepal Rastra Bank’s recent policy adjustments have supported this credit expansion. Notably, the risk weight for loans above Rs 5 million was lowered from 150% to 125%, and borrowers can now allocate up to 70% of their income to repay loan installments. These changes have made it easier for individuals to qualify for larger loans at lower interest rates.

In response, banks have introduced attractive offers such as single-digit interest rates, fixed-rate plans, and deferred installment payments until construction completion. The resulting competition has brought down borrowing costs and encouraged long-term investment in housing.

Among the lenders, NIC Asia Bank remains the largest provider of personal home loans, despite a year-on-year decline of 18.20%. The bank had issued Rs 50.66 billion in housing loans. Global IME Bank follows with Rs 38.50 billion, reflecting a 27.97% increase from the previous year.

Other notable lenders include Rastriya Banijya Bank (Rs 27.79 billion), Nabil Bank (Rs 27.36 billion), Everest Bank (Rs 22.77 billion), NMB Bank (Rs 17 billion), Siddhartha Bank (Rs 13.72 billion), Prabhu Bank (Rs 13.43 billion), and Kumari Bank (Rs 12.55 billion). Agriculture Development Bank and Nepal Bank have also crossed the Rs 10 billion mark, with loans amounting to Rs 10.92 billion and Rs 10.68 billion respectively.

Smaller but active participants include Citizens Bank (Rs 10.57 billion), Sanima Bank (Rs 9.82 billion), Standard Chartered Bank (Rs 8.61 billion), Prime Bank (Rs 8.50 billion), Nepal Investment Mega Bank (Rs 7.39 billion), Machhapuchhre Bank (Rs 6.52 billion), Himalayan Bank (Rs 4.97 billion), and Nepal SBI Bank (Rs 2.37 billion).