Banks Earn Nearly Rs 7 Billion from Stock Market in Nine Months

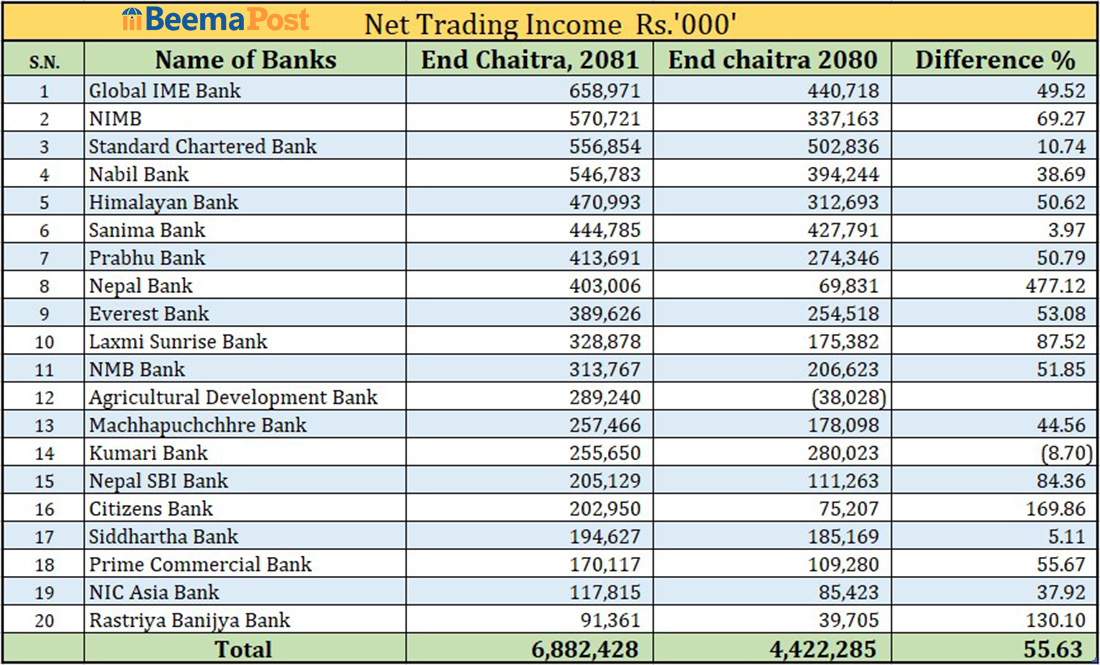

Kathmandu — Commercial banks have earned nearly Rs 7 billion from the stock market in the first nine months of the current fiscal year 2081/82. According to financial data, the 20 operating commercial banks collected Rs 6.88 billion in net trading income by the end of Chaitra — a significant 55.63% rise compared to the Rs 4.42 billion earned during the same period last fiscal year.

This surge comes amid a notable boom in the capital market. The NEPSE index, which was around 1,800 at the start of the fiscal year, climbed to a peak of 3,000 before settling around 2,700. With the central bank allowing banks to invest up to 1% of their paid-up capital in the stock market, their trading profits have risen accordingly.

Global IME Bank led the earnings chart with Rs 658.9 million — a 49.52% increase from last year. Nepal Investment Mega Bank followed with Rs 577.2 million, up by 69.27%. Standard Chartered Bank earned Rs 556.8 million (up 10.74%), Nabil Bank Rs 546.7 million (up 38.69%), and Himalayan Bank Rs 470.9 million (up 50.62%).

Other major earners included Sanima Bank (Rs 444.7 million), Prabhu Bank (Rs 413.6 million), Everest Bank (Rs 389.6 million), and Nepal Bank, which saw the highest percentage growth of 477%, reaching Rs 403 million. Rastriya Banijya Bank also posted a remarkable 130.10% increase, earning Rs 91.3 million.

Laxmi Sunrise earned Rs 328.8 million, NMB Bank Rs 313.7 million, Agricultural Development Bank Rs 289.2 million, Machhapuchhre Bank Rs 257.4 million, Kumari Bank Rs 255.6 million, Nepal SBI Bank Rs 205.1 million, Citizens Bank Rs 202.9 million, Siddhartha Bank Rs 194.6 million, Prime Bank Rs 170.1 million, and NIC Asia Rs 117.8 million.

Among all, only Kumari Bank recorded a decline in income from the stock market, while all others reported gains, driven by the bullish trend in the secondary market during the review period.