Commercial Banks Struggle with Rising Bad Loans: NPLs of Nine Banks Cross 5 Percent

Kathmandu – The growing burden of bad loans has pushed Nepal’s commercial banking sector into deep financial stress, as recovery challenges continue to mount. The latest data up to the end of the Chaitra month of the fiscal year 2081/82 reveals that 18 out of 20 commercial banks have seen an increase in their Non-Performing Loans (NPL), signaling a worsening credit environment.

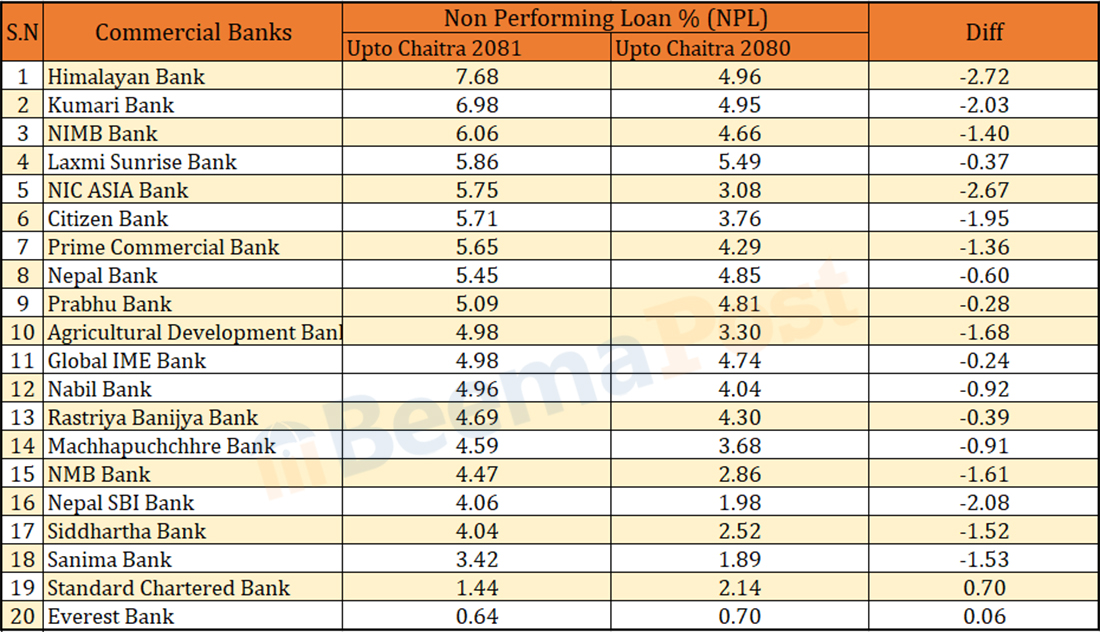

According to the third-quarter reports, Himalayan Bank tops the list with the highest NPL at 7.68 percent—an alarming rise of 4.96 percent from the previous year. Kumari Bank follows closely with 6.98 percent, up from 4.95 percent in the same period last fiscal year.

Nepal Investment Mega Bank’s NPL stands at 6.06 percent, up from 4.66 percent. Laxmi Sunrise Bank recorded 5.86 percent, Citizens Bank 5.71 percent, Prime Bank 5.65 percent, Nepal Bank 5.45 percent, and Prabhu Bank 5.09 percent. These nine banks have crossed the 5 percent threshold, a level considered critical by banking standards.

Other banks are also under pressure. Global IME Bank reported 4.98 percent, Nabil Bank 4.96 percent, Rastriya Banijya Bank 4.69 percent, Machhapuchhre Bank 4.59 percent, NMB Bank 4.47 percent, Nepal SBI Bank 4.06 percent, Siddhartha Bank 4.04 percent, and Sanima Bank 3.42 percent.

In contrast, only two banks—Standard Chartered and Everest Bank have managed to reduce their bad loans. Standard Chartered’s NPL fell by 1.44 percent, while Everest Bank’s declined by 0.64 percent.