South Korea’s Motor Insurance Market Poised for Steady Growth Through 2029 Amid Rising EV Sales: Global Data

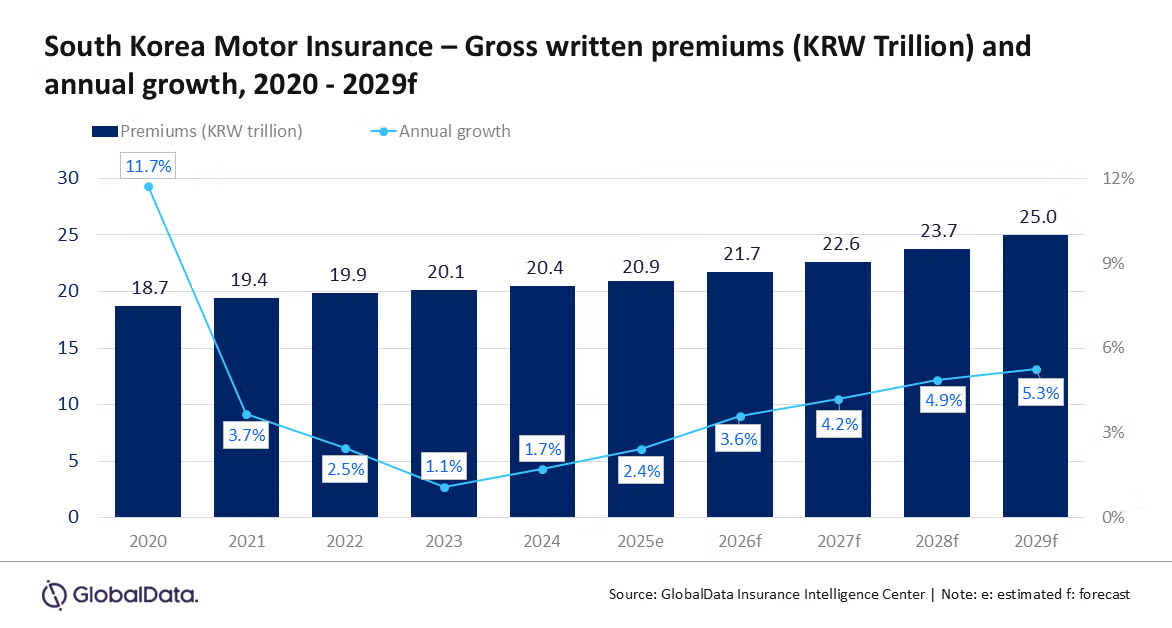

South Korea’s motor insurance sector is projected to expand at a steady pace over the next four years, fueled by a surge in electric vehicle (EV) adoption, increased premium rates, and a rebound in vehicle sales. According to industry research firm GlobalData, the market is expected to grow at a compound annual growth rate (CAGR) of 4.5%, with gross written premiums (GWP) reaching KRW25.0 trillion ($18.6 billion) by 2029, up from KRW20.9 trillion ($15.6 billion) in 2025.

Motor third-party liability (MTPL) currently makes up 12.8% of the motor insurance portfolio, while comprehensive motor coverage dominates with an 87.2% share.

The revival is being shaped by several converging factors. South Korea is witnessing a rise in traffic accidents and labor costs, leading to higher claims and driving up premium rates. Data from the Financial Supervisory Service (FSS) shows that the average loss ratio among the top four non-life insurers rose sharply to 92.4% in November 2024, compared to 81.5% a year earlier. With traffic accidents climbing from 1.78 million in the first half of 2023 to 1.84 million in the same period of 2024, insurers are under growing pressure to adjust pricing to maintain underwriting margins.

A key driver of growth is the rapid penetration of electric and hybrid vehicles. Bolstered by government policies aiming for 100% EV sales by 2040, the EV market saw a 47% year-on-year increase in Q3 2024. These vehicles typically command higher insurance premiums due to elevated risks associated with battery fires and complex repair procedures. Additionally, stricter regulations and improved transparency in battery sourcing have added momentum to the EV transition.

Despite the positive outlook, the industry is contending with challenges. The growing adoption of usage-based insurance models and the expansion of online distribution channels are intensifying market competition and exerting downward pressure on profit margins. Coupled with the potential impact of global economic shifts—such as the U.S. tariff on automobile imports, which could raise domestic unemployment—the pace of growth may be tempered.

Nevertheless, motor insurance remains the backbone of South Korea’s general insurance sector, contributing 58.3% of total GWP in 2024.