World Bank Warns of Slower South Asia Growth Amid Global Volatility; Urges Urgent Tax Reform

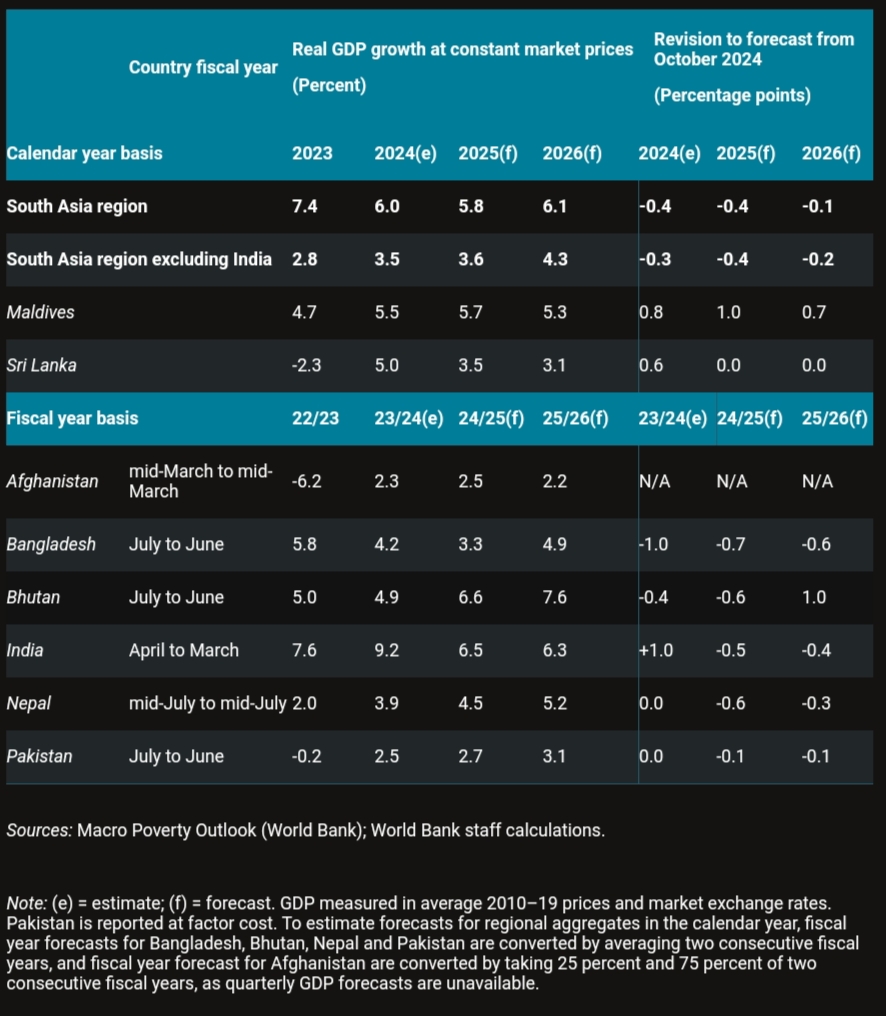

The World Bank has slashed South Asia’s growth forecast for 2025, warning that the region’s fragile fiscal condition leaves it ill-prepared to absorb future shocks. In its latest South Asia Development Update released today, the Bank projects regional growth to slow to 5.8 percent in 2025—down 0.4 percentage points from its October forecast—before rising modestly to 6.1 percent in 2026.

The report Titled “Taxing Times,” calls attention to a growing fiscal vulnerability across South Asian nations and highlights domestic revenue mobilization as the linchpin for economic resilience and long-term development.

“Multiple shocks over the past decade have eroded the region’s buffers,” said Martin Raiser, World Bank Vice President for South Asia. “The region needs targeted reforms to strengthen economic resilience and unlock faster growth and job creation. Now is the time to open to trade, modernize agricultural sectors, and boost private sector dynamism.”

The report draws attention to a persistent contradiction in South Asia’s fiscal structure: tax rates in many countries are relatively high, yet actual revenue collection remains low. From 2019 to 2023, South Asian nations collected only 18 percent of GDP in government revenues, well below the 24 percent average for other developing economies. This mismatch, the World Bank argues, is not merely due to the informal economy or agricultural dominance, but also reflects inefficiencies in tax policy, weak enforcement, and outdated administrative systems.

The report estimates that South Asian countries are collecting between 1 to 7 percentage points of GDP less than what existing tax rates should yield. While large informal and agricultural sectors account for part of this gap, the World Bank emphasizes that systemic inefficiencies, widespread tax exemptions, and weak enforcement remain critical challenges.

Franziska Ohnsorge, the Bank’s Chief Economist for South Asia, cautioned that insufficient revenues not only limit investment in public services but also increase the tax burden on compliant individuals and businesses. |She stated that low revenues are at the root of South Asia’s fiscal fragility.

Diverging Country Trajectories

In India, growth is expected to ease to 6.3 percent by FY25/26, as the impact of monetary easing and regulatory reform is countered by weaker global demand. Bangladesh faces a sharper slowdown, with growth projected at just 3.3 percent in FY24/25, dampened by political uncertainty and persistent financial strain.

Nepal’s economic growth is projected at 4.5 percent in FY24/25, following widespread damage caused by floods and landslides. A tentative recovery to 5.2 percent in FY25/26 remains hampered by structural weaknesses in the banking sector and limited public investment capacity.

Pakistan’s economy continues a fragile recovery, projected to grow by 2.7 percent in FY24/25 and 3.1 percent the following year, after years of inflationary pressure and external shocks. Afghanistan is expected to grow by just 2.5 percent this fiscal year—a rate that fails to keep pace with population growth.

In contrast, Bhutan’s growth is expected to rebound strongly to 7.6 percent in FY25/26, driven by renewed momentum in hydropower construction. Maldives is set to expand by 5.7 percent in 2025, supported by a new airport terminal, though external debt risks persist.

Sri Lanka, emerging from a deep economic crisis, is projected to grow by 3.5 percent in 2025, supported by gradual stabilization and structural reforms. However, growth is expected to ease slightly to 3.1 percent in 2026.

The report presents a mixed picture across South Asia, reflecting the uneven impact of global volatility, domestic policy constraints, and climate-related disruptions.

To address these structural imbalances, the World Bank recommends a comprehensive set of reforms: eliminating inefficient tax exemptions, simplifying and unifying tax codes, modernizing enforcement mechanisms, and leveraging digital platforms to improve compliance. The report also proposes the strategic use of pollution pricing as a dual tool for environmental and fiscal sustainability.